Add Crypto to IndiaStack

Use the digital rupee to facilitate domestic commerce and crypto protocols to attract international investment.

How does an Indian small business owner in the middle of nowhere get a loan from anywhere?

Well, today he is increasingly likely to have a phone, a Reliance Jio connection, and access to IndiaStack: a miraculous collection of national APIs for payment, identity, and more that allows him to easily transact with anyone in India. This software platform is the natural insertion point for the Reserve Bank of India’s recently proposed digital rupee, which will further accelerate commerce within India.

But there’s an important piece that’s still missing, which is comparably easy access to the economy outside India. After all, that small business owner can now use his phone to make not just domestic phone calls, but international ones. So shouldn’t he be able to receive funds from around the world as easily as he can now trade with other Indians?

Crypto makes that possible. As we will show, adding crypto functionality to IndiaStack alongside the digital rupee aids India’s interests in two distinct ways.

First, it helps Indians domestically, by giving them direct access to both Indian and international pools of capital.

Second, it helps India internationally, by developing an open source software stack that any country can use for both domestic and foreign transactions, without dependence on either American or Chinese corporations.

This is a vision of national software stacks and neutral crypto protocols. Put another way, by adding both a digital rupee and cryptocurrency support to IndiaStack, the country would (a) run a permissioned ledger for domestic transactions via the digital rupee and (b) use decentralized ledgers for international affairs.

That would give India the best of both worlds: a domestic digital currency fully controlled by the Reserve Bank of India (RBI), and international payments capability that isn’t controlled by any other country at either the currency or platform levels. The platform for the digital rupee would thus become the same as the platform for digital gold, digital wallets, and decentralized finance. In the argot of our era, it’s blockchain and cryptocurrency, not either/or.

In this piece, we begin by reviewing IndiaStack and crypto, with particular attention to decentralized finance. We then describe the simplest way to add both digital rupee and crypto protocol support to IndiaStack, and illustrate how a Crypto IndiaStack would help India domestically through a series of case studies.

Perhaps the most important of these case studies is expanded upon in a companion piece to this article by iSPIRT, the team behind IndiaStack. It describes how adding crypto support to IndiaStack could help the RBI close India's pressing MSME financing gap by attracting hundreds of billions of dollars in foreign crypto investment for Indian startups and small businesses.

We close by discussing the utility of Crypto IndiaStack for India's foreign policy, as the software philosophy underpinning a reinvigorated Non-Aligned Movement that we term the Decentralized Movement.

About IndiaStack

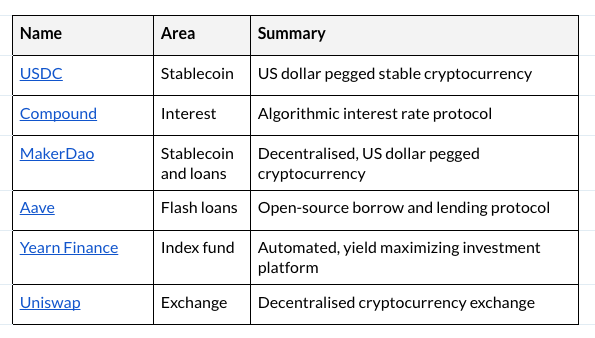

The first step in understanding Crypto IndiaStack is to understand IndiaStack itself. It is a set of national APIs for payments, identity, KYC, e-signature, and document verification that scales to a billion people. Here's a quick overview of the IndiaStack APIs:

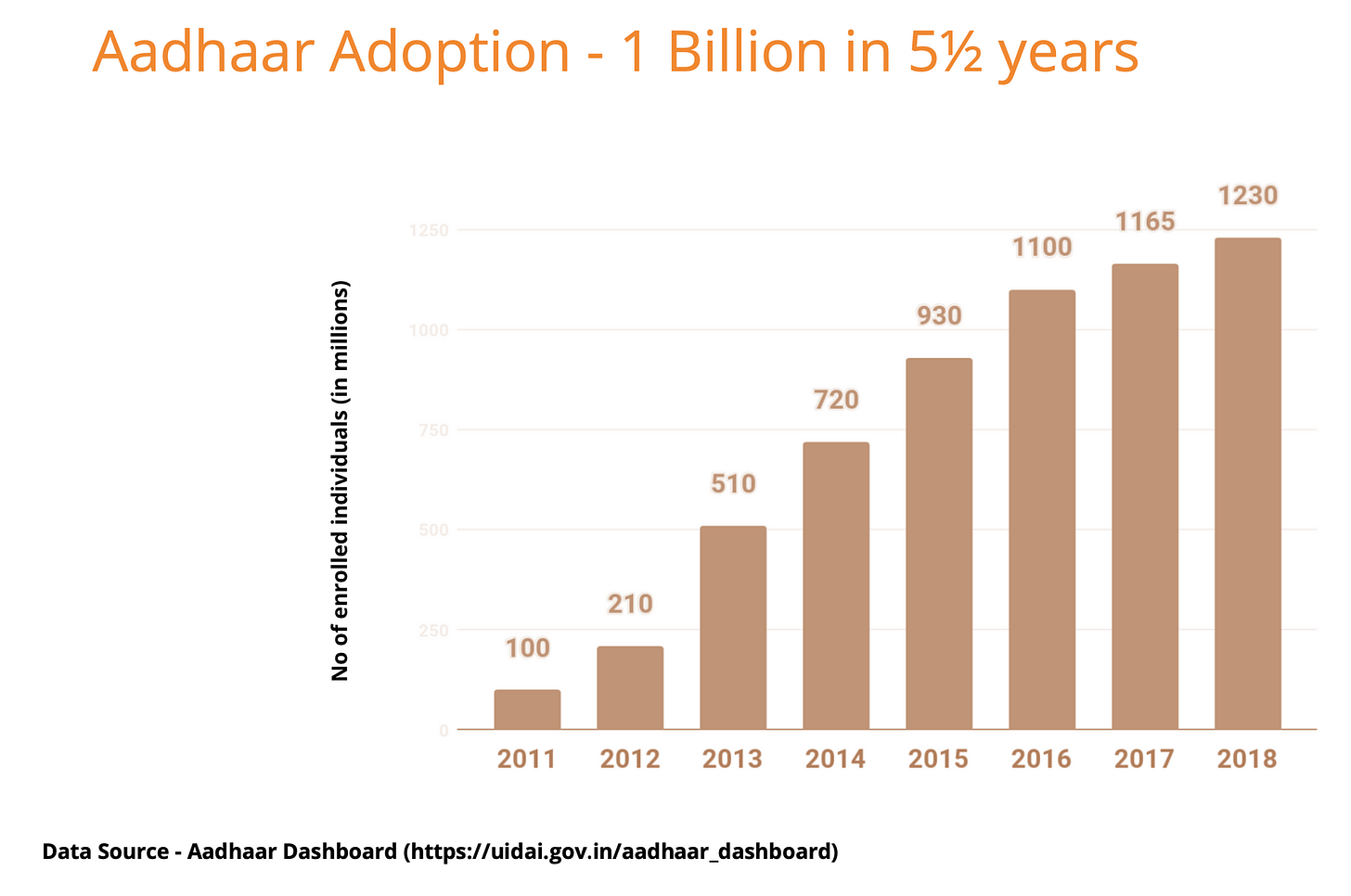

Unlike similar government software projects in other countries, IndiaStack APIs like UPI and Aadhaar are in wide use by companies inside and outside India; the graphs tell the story:

For further reading, the two best contemporary references on IndiaStack are (a) the official developer and policy documentation at indiastack.org and (b) this unofficial guide to IndiaStack by two iSPIRT volunteers. But the take home point is that IndiaStack APIs like UPI and Aadhaar provide world-class software infrastructure for India’s domestic economy.

About Decentralized Finance

The second step in understanding Crypto IndiaStack is to understand the state of crypto in 2021:

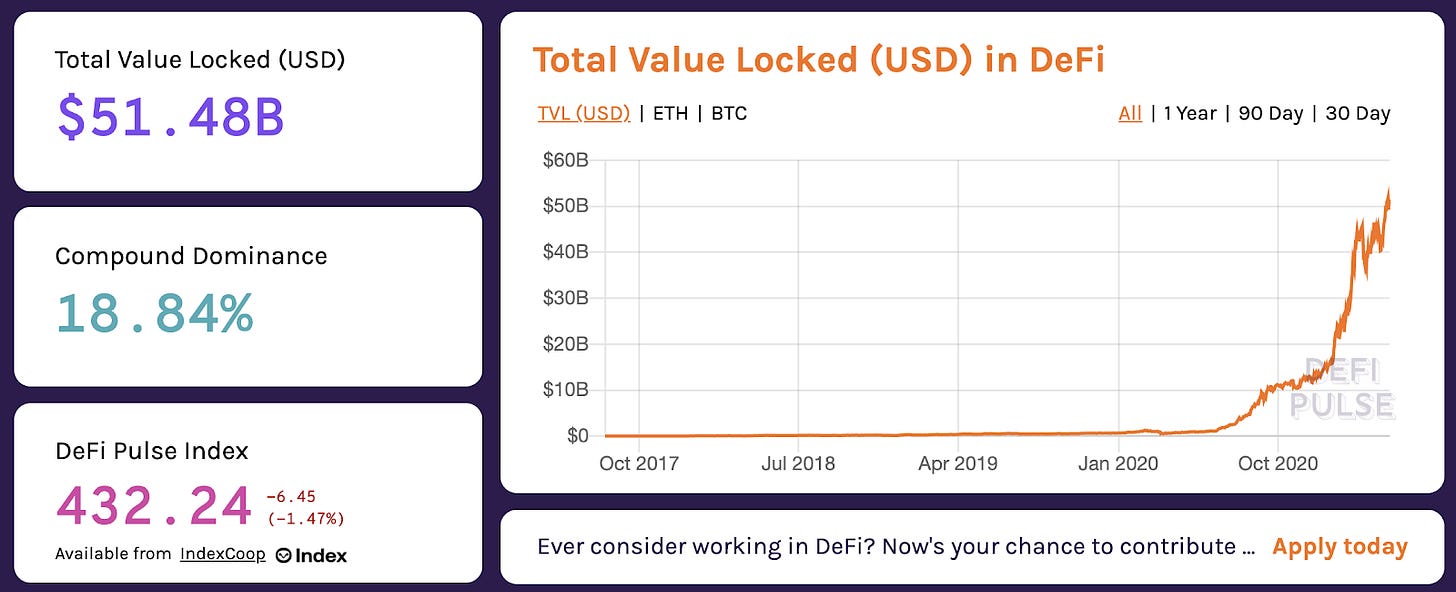

To begin, you’ve probably heard of Bitcoin. But crypto is now bigger than Bitcoin. It also includes newer blockchains like Ethereum, which have enabled the new world of decentralized finance or “defi” for short. This new space is growing at an astonishing pace, with >25X year-over-over growth. It's putting Wall Street on the internet and changing the very foundations of how money is represented and invested around the world. And most importantly for our purposes, defi is making huge pools of capital newly available to any Indian with a digital wallet, in the same way the internet made huge swaths of information available to any Indian with a cellular phone.

Why is that happening exactly?

Performance. First, before getting into defi specifically, crypto in general is good for payments that are very large, very small, very fast, very automated, very international, and/or very transparent relative to the traditional financial system. For example, you can use a stablecoin to programmatically split $100,000 among 1000 different people in 50 different countries to pay each $10 for a microtask, give them a transaction confirmation almost immediately on the Ethereum blockchain, and fully settle the monies within a few minutes such that all 1000 recipients can spend their earnings. You can raise 30 million dollars in 30 seconds on-chain. You can even stream money in realtime, rather than making people wait 2-4 weeks between paychecks. These kinds of feats represent >10X improvements on basic financial primitives and are simply impossible with the old banking system. So crypto has boosted the performance of global finance on many dimensions.

Programmability. In addition to these raw performance improvements, crypto also offers programmability – and this is the core of defi.

Recall that traditional finance or “tradfi” is based on paper contracts, Excel spreadsheets, and enforcement by the occasional court of law. Defi has a different model: it puts the contract logic, the spreadsheet, and the enforcement itself into a single smart contract that runs on a blockchain like Ethereum. Every few seconds, the Ethereum world computer cranks through some calculations and updates the balance of who has made what amount of money. All the property is protected through cryptography, and the contracts are open source and fully transparent to the world. For example, here’s the source code for the smart contract behind MakerDao, a defi lending platform.

The ability to write programs with money is as big a breakthrough as the ability to write programs with documents. It gives Wall Street's capabilities to anyone – including the average Indian – without expensive lawyers or financiers.

Transparency. Finally, decentralized finance is far more transparent, and hence trustworthy, than tradfi. Every transaction is logged on-chain and protected by encryption, which allows for cryptographically rigorous accounting and audits. More reliable financial statements are a form of informational collateral; as discussed below, this kind of data may be crucial to unlocking new investment in physical-collateral-poor regions.

Performance, programmability, transparency...this starts to give you a flavor of what defi can do, but to really get it you should experiment with some of the top defi protocols. You can try these out by buying Ethereum at an exchange like Coinbase or Binance and then trying out the following applications:

The space is growing so fast that it’s impossible to summarize everything that's happening; the best references to keep track are defipulse.com (to view all the protocols), coinmarketcap.com (to look at the valuations of their underlying tokens), and coindesk.com (for discussion on these protocols).

The main point, though, is that defi is to finance what the internet was to information. Just like the internet gave the average Indian access to millions of new sources of information, decentralized finance has the potential to give every Indian direct access to millions of new sources of capital.

And as discussed below and in iSPIRT's companion piece, defi could be particularly helpful for India's micro, small, and medium-scale enterprises, which the Reserve Bank of India estimates to need another 20-25 trillion rupees (~$250-330B USD) in financing beyond existing domestic capital pools.

Four Steps To Add Crypto to IndiaStack

OK. We now understand a bit about both IndiaStack and crypto, particularly decentralized finance. Why is the combination so powerful? Well, there are now hundreds of millions of smartphones in India. By adding both a digital rupee and crypto support to IndiaStack, we could turn every phone into not just a bank account but a bonafide Bloomberg Terminal, giving every Indian the ability to make both domestic and international transactions of arbitrary complexity, attracting crypto capital from around the world, and leapfrogging the 20th century financial system entirely.

How do we get there? In four easy steps:

Understand what a digital rupee is.

Add digital wallet support to IndiaStack.

Add crypto assets to the IndiaStack digital wallet.

Extend IndiaStack APIs with crypto concepts.

1. Understand what a digital rupee is.

The first step is to nail down exactly what the digital rupee even is. The concept can be confusing for many people; after all, don’t they see a digital balance of rupees in their bank account already? So what would a digital rupee do anyway?

The short answer is that a national digital currency would give everyone the ability to hold and send money without a bank in the middle, just like email gave everyone the ability to store and send mail without a post office in the middle. The longer answer revolves around the ability to download and hold currency on your device, similar to downloading a file, and can be understood in a few stages.

Stage 1: Physical currency. This is currency you can hold in your hand. You can go to the ATM to (a) withdraw physical cash, and then (b) hold those notes in your physical wallet, (c) hand them to someone else, or (d) feed them back into another ATM to update your online balance. Physical currency thus permits download, storage, peer-to-peer transfer, and upload outside the confines of the banking system.

National quasi-digital currency: banks and fintech APIs show balances, but don't let you withdraw to your device.

Stage 2: National quasi-digital currency. This is national currency like rupees or dollars that may be visible on screens but is only quasi-digital. That is, when you log into a bank website or fintech app, you can view your balance in rupees and dollars, but there is no analog to “getting physical cash from the ATM”. So unlike physical currency, you can’t download a quasi-digital currency, hold it on your computer, or send/receive it outside of a corporate interface. That's why it's quasi-digital: it doesn't have the flexibility of a true digital currency. Specifically, only banks or their fintech partners can currently hold, send, and receive the national quasi-digital currency that you see in their web interfaces. And this is the status quo for non-crypto users today.

Stage 3: Quasi-national digital currency. Sitting diagonally opposite from a national quasi-digital currency is a quasi-national digital currency. Here, we have something which is genuinely digital but that is not actually directly issued and licensed by the government (hence, "quasi-national").

This is how privately issued stablecoins currently work. They are blockchain-hosted digital assets, pegged 1:1 to a national currency, with 100% of value backed by fiat currency that is held by a private issuer in traditional bank accounts. Because these stablecoins are issued by individual companies or consortia, not governments, they are only quasi-national.

But they are fully digital. Right now, you can log into a crypto exchange like Coinbase or Binance, see a cryptodollar balance, and download it to your device by sending it to a wallet hosted on your laptop or phone, as per the screenshot above. This is the status quo for crypto users today.

Stage 4: National digital currency. A truly national digital currency would combine the legitimacy and distribution of a sovereign issuer like China or India with the flexibility of a natively digital currency. The full feature set of such an asset is still to be determined, but if it's comparable to a stablecoin you would be able to download the amount you see in your banking interface to your hard drive, hold it locally on any device with the right digital wallet, and send/receive the funds to any other wallet user.

Unlike a stablecoin, however, a national digital currency (also known as a central bank digital currency or CBDC) would be issued by and backed by a central bank, so the adoption within a country may be far wider. The central bank can still intervene to freeze funds or reverse transactions for a national digital currency under unusual circumstances, but most other uses would be cash-like and not interfered with.

So, that’s the progression from physical currency through two different kinds of intermediates to the proposed concept of a national digital currency. And this gives us some sense of how the digital rupee may differ from the status quo: it's money you can download to your device and load into apps, just like withdrawing physical cash from an ATM that you then feed into a vending machine. This may seem like a small change, but it expands the number of entities that can hold, send, and receive national currency from a few licensed banks and fintechs to hundreds of millions of citizens and devices. It's like the transition from a few phone companies routing calls to any computer being able to send and receive packets to any other computer over the internet.

Now, how would you implement a national digital currency?

2. Add a digital wallet to IndiaStack.

The first step would be to add a digital wallet to IndiaStack with support for a digital rupee. The right insertion point would be the Unified Payments Interface, which already connects hundreds of Indian banks. Any computer running the IndiaStack open source digital wallet would then be able to download digital rupees and send them to any other computer running the digital wallet, potentially without going through a bank or fintech intermediary. Each such transaction could work much like the current UPI, with instant payments between wallet holders, though many concepts from blockchains could be used to protect user security, such as local private keys.

By the way, that’s a general principle: rather than designing the digital rupee completely from scratch, it may be helpful to integrate battle-tested concepts from UPI with working code from public blockchains like Ethereum. The reason is that many of the scaled stablecoins already use Ethereum, most developers in the space are familiar with Ethereum concepts, and large banks like JPMC already use Quorum, a permissioned version of the Ethereum blockchain.

A rough preview of how a digital rupee might work could be provided by the USDC stablecoin, a digital dollar that we launched during my time at Coinbase. Anyone can exchange American dollars (USD) for USDC in a 1:1 ratio at a crypto exchange like Coinbase or Circle. All know-your-customer (KYC) verification is performed at that stage. Then, once onboarded into USDC, users can send and receive to each other without further approval – removing all friction from subsequent transactions. And they can also write smart contracts involving USDC, which are to bank wires roughly what web apps are to telephone calls. Depending on RBI's preferences, a digital rupee could be implemented in a similar way and with similar controls, with IndiaStack's Aadhaar and eKYC APIs used for verification and Indian crypto exchanges, fintechs, and banks used for INR to digital INR conversion.

3. Add crypto assets to the IndiaStack digital wallet.

Very quickly, users of the IndiaStack digital wallet and digital rupee will demand crypto functionality. Why? For many reasons, but perhaps most importantly because Indian users will want to access pools of crypto capital from around the world. Foreign holders of Bitcoin, Ethereum, and other crypto assets want to invest in the Indian economy, and they will want digital rupees in return at some phase of the deal. Facilitating this capital formation could help close the MSME financing gap, as discussed below and in iSPIRT's companion piece.

Concretely, that means IndiaStack’s digital wallet would support not just a UPI-integrated digital rupee, but also Bitcoin, Ethereum, and other digital assets over time. The digital wallet would then contain the API keys and private keys necessary to interface with both a national digital currency and select decentralized blockchains. It would focus on low-level support for sending, receiving, and holding balances, and rely on entrepreneurs to embed and extend the software.

Entrepreneurs could then embed the digital wallet into web and mobile apps to serve different kinds of use cases, including foreign exchange, remittances, crypto exchanges, stock markets, and international crypto investment in Indian companies.

4. Extend IndiaStack APIs with crypto concepts.

The fourth step in building Crypto IndiaStack would involve going API by API and gradually crypto-ifying them, extending IndiaStack’s domestic APIs with ideas from the blockchain space and connecting them to international crypto protocols as needed. Here are a few ideas for how this might proceed:

The sketches in the table above are just ideas, pointing to cognates of the domestic IndiaStack APIs that exist in international crypto protocols. In each case, IndiaStack could use existing technologies, fork them, or build new ones from scratch. All three would be reasonable approaches, and based in part on the decisions of other actors. Each would be a pragmatic build-vs-buy decision; the goal is to bridge the IndiaStack-powered domestic economy to the international cryptoeconomy.

This completes our whirlwind tour of how you'd build a Crypto IndiaStack: understand how a digital rupee works, add a digital wallet to IndiaStack, add support for key digital assets to bring crypto capital to India, and then integrate more crypto concepts over time.

The next step is to go into more detail on why you'd build a Crypto IndiaStack. Why combine a digital rupee for domestic commerce with crypto protocols for international transactions? Because this combination will maximally benefit Indians both domestically and internationally. Let’s go through why.

Why Crypto IndiaStack Helps Indians Domestically

First, what are the domestic benefits of a Crypto IndiaStack? As mentioned above, if the internet connected Indians to millions of sources of information, crypto could connect them to millions of sources of capital.

Here, we go through five specific scenarios that illustrate how Indians from all walks of life — small business, startup, student, remittance recipient, and rural Indian — benefit from adding the digital rupee and crypto protocol support to IndiaStack. Of these, perhaps the most important is the use of crypto to help close the small business financing gap, as detailed in iSPIRT's companion piece.

Background: Debt, Equity, Collateral

But before we understand the problems crypto solves for Indians we need to understand a bit about financing.

There are two broad ways to get financing for a business: equity and debt. With debt, you take out a loan and have to repay it over time, with interest. Usually there is some collateral in place in the event you can’t repay. With equity, you sell a piece of your company to an investor, and if that company itself is sold to a buyer, or goes public, the investor can turn a profit. Debt is generally lower-risk and lower-reward than equity.

Some situations are more suitable for debt financing, others for equity. Here are a few examples:

Debt financing with traditional collateral and cash flows. You have a large business with demonstrable cash flows. You take out a loan, and the bank has something as collateral, like the equipment in your factory, in the event you don’t repay it with interest.

Debt financing with informational collateral and cash flows. You run a micro, small, or medium scale enterprise (MSME), an operating business with demonstrable cash flows. However, you lack physical collateral. What you have instead are digital receipts, a form of informational collateral. You want to take out a loan using this data.

Equity financing with no cash flows. You are an ambitious startup with no cash flows. You may have something analogous to informational collateral in the sense of your past track record. However, a loan doesn’t make sense because you have no revenue and wouldn’t be able to pay it back. So instead you do equity financing, raising angel investment or venture capital.

Equity financing with informational collateral, no cash flows, and no company. You are an individual who needs money, like a student. You don’t have a startup or small business. But you do have a decent academic track record. You'd benefit from micro-equity financing, as a debtless analog to traditional microfinance.

Each of these financing situations is improved by adding crypto support to IndiaStack. Let's go through some case studies.

Five Case Studies on Crypto IndiaStack's Domestic Benefit

As we will show in case studies 1-3, defi lending expands the pool of lenders for Indian businesses with either physical or informational collateral, crypto crowdfunding enlarges the set of possible investors in high-risk Indian startups, and personal crypto tokens provides a way for any Indian student to raise money against their reputation from investors around the world.

In case study 4, we show how Crypto IndiaStack helps with remittances and in case study 5 we discuss how it can extend the capabilities of rural Indians' no-frills bank accounts via decentralized finance.

Case Study 1: Indian MSMEs use Crypto IndiaStack to gain access to crypto credit

Problem. The 60+ million Indian micro, small, and medium size enterprises (MSMEs) often don’t have access to credit and lack physical collateral. The Reserve Bank of India estimates that 93% of MSMEs had no finance or depended on self‐finance, and that India needs another 20-25 trillion rupees (~$250-330B USD) beyond existing capital pools to fully fund these businesses:

“In India, the total addressable demand for external credit is estimated to be ₹37 trillion6 while the overall supply of finance from formal sources is estimated to be ₹14.5 trillion Therefore, the overall credit gap in the MSME sector is estimated to be ₹20 – 25 trillion.”

— Report of the Expert Committee on Micro, Small and Medium Enterprises, Reserve Bank of India

Without this money, you get lack of growth, unregulated capital markets, loan sharks, high interest rates, and constant state intervention to prop up failing enterprises.

Solution. Where might this money come from? It could be crypto. Again, just take a look at the growth rate of decentralized finance:

Defi was only $1-2B last year, so it's grown 25X in a year's time, and may be a trillion dollar sector in a few years. Very few economic trends are that big and growing that fast! And as noted above, there are already a slew of decentralized finance tools to take out different kinds of loans, with more launching every day. Here are a few of them.

Some of these crypto lending platforms, like MakerDao, require crypto as collateral. Others, like the newer Goldfinch, do not. And newer protocols are under development that generalize services like Square Capital and Stripe Capital to use informational collateral such that asset-poor businesses with real cash flows can get credit from global pools.

Recommendation. India should encourage foreign crypto investors to finance Indian businesses and use Crypto IndiaStack to connect Indian MSMEs to crypto lenders, as a major extension of peer-to-peer lending. See also iSPIRT's companion piece to this article which goes into further detail.

Case Study 2: Indian Startups use Crypto IndiaStack to raise crypto crowdfunding

Problem. Indian startups need capital to grow. India is #3 in unicorns by valuation, but the ecosystem of successful angels and venture capitalists is still not at the same level of maturity as Silicon Valley.

Solution. Crypto provides direct access to not just traditional Silicon Valley investors, but the entire world. Crypto crowdfunding has already shattered previous records. In 2015, the top online crowdfunding projects raised tens of millions; by 2017 they were able to raise billions, a 100X improvement in a matter of two years. As a concrete example, Indian developers who built an Ethereum scaling service called Polygon were able to attract crypto capital from around the world, turning them into India’s first crypto protocol valued over $1B.

Recommendation. India should legalize crypto crowdfunding and token sales, such that Indian founders can use Crypto IndiaStack to directly source capital from global crypto investors.

Case Study 3: Indian Students use Crypto IndiaStack to issue personal tokens

Problem. The Indian student from an IIT may be able to raise capital on the basis of a brand name, but it’s quite a bit harder for the meritorious student from an ITI.

Solution. Indian students and first time entrepreneurs can now access capital directly by minting personal tokens that their friends and family can invest in. Last year, former Coinbase employee Reuben Bramanathan launched a personal token that buyers could redeem for an hour of his time. Crypto entrepreneur Alex Masmej did something similar, selling $20k worth of personal tokens to investors to redeem for the lesser of 15% of his future income or $100k over the next three years. Investors who buy and hold these personal tokens are essentially betting that an hour of a promising person's time might someday become more valuable.

It's like equity investment in a person, or micro-equity financing, which is particularly interesting for India as an alternative to student loans or microfinance debt.

One question immediately arises: how do investors know they'll get paid back on such high-risk bets on individuals? India's GST e-invoicing API helps here. Once the funded individual begins engaging in business, the GST network routinizes revenue reporting and makes topline income harder to misrepresent. This addresses an issue that has lead to widespread microfinance defaults, and is another way in which India's domestic software infrastructure can be bridged to international crypto markets to attract overseas capital.

Recommendation. India should legalize personal tokens and encourage their use alongside informational collateral, provided by GST e-invoicing or other means, as a way for international investors to bet on promising young Indians through Crypto IndiaStack.

Case Study 4: Indian Guest Workers & BPOs use Crypto IndiaStack for remittances and remote work

Problem. Millions of Indians around the world want to send remittances back to India, but face long wait times and paperwork, especially for large amounts. Millions more employees in the BPO space have to deal with similar issues for receiving funds for remote work.

Solution. Crypto allows users to send and receive payments internationally as easily as they do domestically. The difference between the current remittance environment and crypto is the difference between physical mail and email. UPI is starting to be used outside India in limited ways, but a crypto-enabled IndiaStack would give full international support overnight.

Recommendation. India should encourage the use of crypto remittances via Crypto IndiaStack as a way of getting money into India, based in part on the benefit it has already derived from the Liberalised Remittance Scheme (LRS) for outbound flows of money. India should also encourage Indians to use crypto remittances instead of foreign-owned platforms like PayPal, to protect Indian citizens from being arbitrarily deplatformed.

Case Study 5: Indian rural citizens use Crypto IndiaStack's digital wallet to access more financial services

Problem. Hundreds of millions of Indian citizens in rural areas now have no-frills Jan Dhan accounts. They are currently being used by the Indian government to transfer benefits digitally. However, the money is typically just withdrawn into physical cash.

Solution. By instead putting this money into the Crypto IndiaStack digital wallet with the digital rupee, one could start connecting Jan Dhan holders to both the digital domestic economy and the international cryptoeconomy, thereby generating income, credit scores, and informational collateral for people who previously used only physical currency. This informational collateral could be used for underwriting new kinds of financing, in which smart contracts hooked to the Crypto IndiaStack digital wallet would facilitate high-trust repayment to investors all around the world. It would be comparable to the impact of the smartphone; hundreds of millions of Indians would become as able to access financial services around the world as easily as they can now access information sources.

Recommendation. Extend Jan Dhan by adding a digital wallet to IndiaStack capable of holding digital rupees, interacting with global crypto protocols, and recording informational collateral.

To review, we just went through five different case studies in how a crypto-capable IndiaStack could help Indians domestically:

MSMEs can get access to crypto loans

Startups can get access to crypto crowdfunding

Students can sell personal tokens

Guest workers and remote workers can receive money from overseas

Rural citizens can use digital wallets to complement their basic Jan Dhan bank accounts and access more financial services

In addition to these domestic benefits, there are substantial international benefits to a Crypto IndiaStack.

Why Crypto IndiaStack Helps India Globally

As the US and China slug it out in a Second Cold War, India can help the rest of the world take a different path. Think of this as a reinvigorated Non-Aligned Movement, except it'd be a Decentralized Movement that actually does align its members behind national stacks and neutral protocols.

National Stacks

What’s a national stack? It’s a suite of services, either government or private or both, that make a country digitally independent of American or Chinese companies like Facebook or WeChat. For example, India has UPI, Russia has the Yandex search engine, and South Korea has the Naver portal and shopping service; these give partial domestic alternatives to PayPal, Google, and Amazon respectively.

Countries across the world from Mexico to Germany to India to Turkey are now moving to limit what US and Chinese tech companies can do to their citizens. Every region of sufficient scale is now interested in becoming robust to American and Chinese digital surveillance and deplatforming.

But a huge issue here is market size. Many countries lack the technical strength or user base to build something comparable to America or China’s best. US and Chinese companies are globally strong because they have enormous domestic markets and large pools of talent and capital.

India, however, is at a scale where it could conceivably export the national stack used to run the country. We already have a proof-of-concept: mosip.io, an open source Aadhaar-inspired identity platform that is currently being used abroad by countries like the Philippines. And you could imagine a white-labeled version of Koo, the Indian Twitter, which would allow any country to run its own domestic Twitter.

Now that we are twenty years into the era of social networks, search engines, payment, and identity platforms, this could be generalized across services to create a NationStack: an open source version of IndiaStack, potentially bundled with on-prem versions of private Indian services like Koo, that could export India’s domestic software stack as something that works for any country. This would include a localizable version of UPI and the digital rupee, such that (say) the Philippines could set up a digital peso using the same infrastructure as India.

The success of mosip.io furnishes major proof points towards this ambitious vision, which would essentially be a national operating system. If it worked, it would generate hard currency and soft power for India. The US and China wouldn't have the requisite trust to sell something like this in the middle of the Second Cold War. And the pitch would be simple: if NationStack handles a billion Indians, it will probably work for your country.

Neutral Protocols

The NationStack concept is a long-term vision for India to help every country gradually replace services managed by American and Chinese corporations with locally-operated tech platforms and national digital currencies.

But this only offers a theoretical solution to domestic trade and communications. Indians – and citizens of other countries – will still want to engage in international exchanges across borders. And that’s where crypto comes in. Because decentralized crypto protocols can't be controlled by any country, they are natural "Schelling points" for people to align behind for international trade, much like engineers tend to use open source software over corporate APIs when available.

Crypto thus gives a third paradigm outside either US or Chinese control. And as the rising third power in the world, India can credibly advocate the use of decentralized crypto protocols for international affairs if it adds crypto support to IndiaStack.

Instead of a mere Non-Aligned Movement where every country is solely defined by being against US or Chinese control, but has no other commonality, India could champion an aligned movement, a Decentralized Movement, where countries were economically aligned behind decentralized crypto protocols like Bitcoin and Ethereum that all of them benefit from but none of them control.

Precedents for this include things like Linux and the Law of the Sea, which are two different kinds of "demilitarized zones". In the case of open source software like Linux, any country can customize it to their own purposes without being denied access by anyone else. In the case of the Law of the Sea, a series of conventions between states protects free trade in international waters. Crypto protocols combine aspects of both, as open source software that implements a series of conventions to facilitate international trade and communication.

Crypto protocols therefore give small states a superior alternative to grudgingly siding with one side in the Second Cold War, or trying to build something comparable to America or China's best. A country of 5M people that joined the Decentralized Movement would no longer be competing with 300M Americans or 1.4B Chinese, but would be economically aligned with 100M+ global crypto users – potentially soon including a billion Indian users of Crypto IndiaStack and millions of Americans and Chinese to boot.

That's a scale benefit, but it's also a soft power benefit. Because millions of American and Chinese citizens support crypto, any aggressive move towards decentralized crypto protocols by the US or Chinese governments would face significant external and internal pushback. By implementing a Crypto IndiaStack and becoming the international champion of decentralized crypto protocols, India could be the neutral third party that facilitates rather than dominates the world. This helps Indians internationally, by raising India’s profile globally as an innovator and peacemaker.

Summary

All right! We covered quite a lot of terrain. But that's the long-form case for how and why we should build a Crypto IndiaStack. Just to briefly summarize:

Add both digital rupee and crypto protocol support to IndiaStack. It's not blockchain or cryptocurrency, it's both/and. Call this fusion Crypto IndiaStack, and use it to give access to both domestic payments and international crypto protocols on every phone.

A Crypto IndiaStack would help Indians domestically by giving them access to crypto capital. Adding crypto to IndiaStack helps India domestically by enabling new forms of debt and equity financing for every Indian, by connecting them to global pools of crypto capital. It helps close the $250B+ MSME financing gap, it gives startups access to a burgeoning financial internet, and it allows fast payments for remote workers and remittance recipients.

A Crypto IndiaStack enhances India’s prestige abroad, as the software stack for a multipolar world. India should champion national stacks and decentralized crypto protocols as a way to (a) allow countries to gracefully reduce their dependence on both American and Chinese tech companies, (b) earn hard currency for the Indian state and Indian citizens, and (c) develop India's reputation as a peacemaker, a neutral third party, a software superpower, and a global facilitator.

All it takes is a few well-placed keystrokes. Add digital rupee and crypto support to IndiaStack, and leap forward in world affairs.