The Meme Economy

Quantifying the value of culture creation with crypto.

By Harry Jones, Meme Tsar at Dank Bank.

Note: This post was originally created at 1729.com which has evolved into thenetworkstate.com.

If you spend enough time on the internet, you’ve probably heard the term ‘meme stock’. You may have also heard of diamond hands, tendies, apes, and /r/wallstreetbets. Maybe you’ve even seen teenaged ‘investment advisors’ shilling SafeMoon and hotel soap on TikTok. These terms and concepts are all part of what is often described as the meme economy.

In the meme economy, the market performance of a stock or cryptocurrency is less about forecasting business revenue than it is about gauging a traded asset’s “memeability.” This user-generated, virality-based investment strategy can best be explained by René Girard’s mimetic theory of desire, which argues that “human desire is not an autonomous process, but a collective one. We want things because other people want them.” And when those things are also scarce, like stocks or NFTs, they become immensely valuable.

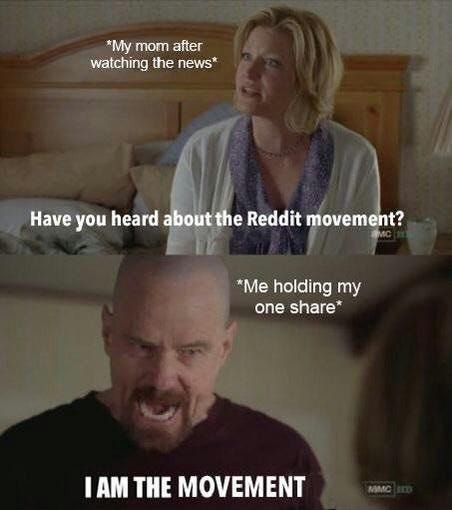

Mimetic desire causes people to invest en masse into things that they have little knowledge of beyond who else is a part of the movement. The social proof provided by friends and influencers creates a network effect that, especially when combined with a genuine value proposition, is powerful enough to commandeer entire financial markets.

“While traditional investing moves along the lines of traditional media (be it TV, Radio, or also online publications with a top-down approach), meme investing instead has developed as a result of “user-generated” investment strategies. The platforms to communicate have been Reddit and Twitter.” — Gennaro, Understanding Meme Economy

For a real-world example of this in action, look no further than the GameStop and Dogecoin phenomena, driven by the /r/wallstreetbets subreddit. With Wall Street Bets, Redditors have fashioned an entire political movement out of what began as a proudly degenerate investing subculture. Members share an innate distrust of centralized financial markets fueled by what they characterize as blatant government corruption, lack of transparency, and institutionalized market manipulation.

The /r/wallstreetbets crowd views the meme investing crusade as an opportunity to take back power. Many of the top posts on the subreddit are firebrand political statements in the form of memes, petitions, and literal class action lawsuits, and it has quickly become one of the most cohesive political movements to ever form on the internet. If prices are already completely decoupled from intrinsic value because institutions, governments, and billionaires manipulate markets for their own benefit, why should regular people be criticized or prevented from banding together to do the same?

“Memes are fun and memes are also something to come together around. Speculating on the popularity of memes and their staying power is no different than any other form of speculation… I’ve decided that I am going to stop ignoring and dismissing meme investing and start trying to understand it better. I think it is not something that is going away anytime soon and may turn into something even more interesting.” — Fred Wilson, Meme Investing

While the Gamestop and Dogecoin phenomena are powerful signals, the endgame Fred Wilson alludes to, perhaps unknowingly, is the ability to invest in memes themselves.

A Brief History of the Meme Market

The idea of a meme economy long predates /r/wallstreetbets and GameStop. Before Redditors hit on the idea of meme-driven investing in real stocks, there was a thriving but fake marketplace for actual memes online — a kind of “fantasy baseball” version of a meme market, but without real money changing hands.

The Know Your Meme definition is instructive: “[The] Meme Economy is a satirical concept and internet subculture in which memes are discussed in the jargons of the financial industry, as if they are commodities or capital assets with fluctuating values.”

The subreddit r/MemeEconomy now boasts 1.4 million followers — self-proclaimed “meme analysts” — each dedicated to uncovering and “investing” in the memes that they believe have the most viral potential.

These meme “investors” are competitive, with Forbes having published a ranking of the community’s “top investors.” There are even in-depth guides to help usher in novice meme traders. For instance, A Beginner’s Guide to the MemeEconomy and Meme Trading advises new meme traders as follows:

“Keep a sharp eye out, and don’t rely too heavily on the community to cherry pick all the profitable memes for you. Do your own research and hunt them yourself every once in a while. Doing this will grow your aptitude for picking out the freshest and dankest memes. Not only will you be one of the first to stumble upon the next possible meme trend, but there is also a sense of satisfaction knowing that you were there in the beginning.”

Meme markets like NASDANQ and MemeTrades even offered the first online stock brokerage platforms for internet memes and were “equipped with basic functionality, such as buying and selling memes and setting firms” (source).

Meme Insider, a dedicated meme magazine, also offered “various insights and advice on the market conditions of meme exchange in the vein of financial news magazines like Forbes.”

But without real money involved, these platforms were unable to offer much more than a gimmick (despite their popularity). Memes had no real monetary value, until…

NFTs

NFTs have opened the door to digital collectibles in a way that was never before possible. I won’t spend time extolling the virtues of NFTs themselves here, but “A Beginner's Guide to NFTs” by Linda Xie and The skeptics’ introduction to cryptoart and NFTs for digital artists and designers are both excellent introductions to an industry that had a sales volume of $2.5 billion in the first half of 2021.

Some of the most successful NFT projects like NBA Top Shot, the PUNKS comic, and the myriad crypto-art platforms have succeeded in replicating and vastly improving upon their real-world/meat space collectible counterparts: basketball trading cards, comic books, and physical art. Seeing their value as NFTs is conceptually simple given that they each already have a physical equivalent.

What has begun more recently, though, is the NFT-ization of digitally native content — the things which have never had a physical counterpart, like memes and viral videos.

The meme economy has quickly become a reality, with the creators of the internet’s most iconic memes auctioning NFTs for hundreds of thousands, if not millions of dollars: Doge — $4 million, Disaster Girl — $570,000, Nyan Cat — $515,000. The list goes on (check out my collection!)

The most valuable collectibles will always be the most culturally significant ones, and there is nothing more culturally significant on the internet than memes. And love it or hate it, NFT memes have the media’s undivided attention. Here’s just a tiny sampling:

Wired: They were ancient internet memes. Now NFTs are making them rich

The Guardian: NFTs and me: meet the people trying to sell their memes for millions

Decrypt: Here Are the Classic Internet Memes Finding New Life as NFTs

BBC: Harambe: Gorilla photo to be sold as an NFT five years after he was shot dead

Mashable: Classic memes that have sold as NFTs

Each massive auction reflects the fact that there has never been a medium that embodies and influences the public consciousness quite like memes. Memes are art and have revolutionized the way we communicate. Rosanna Guadagno, researcher at the Pace Innovation Lab at Stanford University, argues that memes are a “reflection of our culture”.

Meme creators who sell NFTs are not greedy hyper-capitalists looking to scam unwitting buyers. They are regular people who, often without their permission, became universally recognized cultural symbols (and sometimes laughingstocks) without any monetary reward… and now they’re finally getting the payout they deserve.

Unlike sports cards and NBA Top Shot, where players are rewarded with little to none of the proceeds from the sales of their valuable collectibles (which are only valuable because of their talent), meme creators are the direct beneficiaries of sales.

Zoë Roth, the subject of “Disaster Girl”, described her auction as “a way for her to take control over a situation that she has felt powerless over since she was in elementary school,” with every societal ‘disaster’ inevitably prompting a resurgence in the meme. She called it “a once-in-a-lifetime feeling” to “finally [have] some say in what happened with [the meme].” Zoë was able to pay off her student loans after Disaster Girl sold at auction for $500,000, then donated much of the rest to charity.

In the same article, Kyle Craven (Bad Luck Brian) described NFTs as “the only thing that memes can do to take control.”

The Future of the Meme Economy

In the not-too-distant future, every meme will begin as an NFT, and it will be possible to invest in memes before they go viral. The more legendary memes will sell for the kinds of large sums we’re seeing right now in NFTs, but investing in nascent memes will be accessible to investors without deep pockets.

The free and open meme economy will enable savvy memesters to use existing memes as on-chain templates, rewarding the original creator with ownership in the new meme. We’ll even be able to trace a meme’s distribution/’spread’ in real-time as it’s engaged with, invested in, and templated.

Memers are already becoming millionaires (deservedly so), and it’s only a matter of time before it will be possible to make a lucrative career for oneself out of meme creation and curation.

Eventually, all intellectual property rights will take the form of NFTs, a development that Jake Brukhman argues will make NFTs “the biggest asset class in blockchain.”

Believe me when I say that we’re well on our way.

✅ Task: Earn $10 in ETH for Meme Economy Startup Links

Crowd-source a list of startups

We're building a list of Meme Economy startups, and we need your help. Submit a link to a startup launch blog post, news article, or other coverage of a new Meme Economy startup, and we'll pay you $10 in ETH for each link we accept.

🏆 Winners: Best Meme Economy Startup Links

Dozens of submissions received $10 in ETH for their links to Meme Economy startups. See several of the most popularly submitted startups linked below.