America's $175 Trillion Problem

The true state of the global financial system, in ten charts.

We're headed for something far worse than 2008.

As Elon, Dalio, and Jamie Dimon all recognize, the Western world is headed for a sovereign debt crisis. Just like the establishment was hiding the president’s senility, they’re also hiding the true state of the economy. But let’s calibrate with the ten charts below, and then you can judge for yourself.

Note: this post and the followups got 4M+ collective views on X.

See here for the discussion: 1, 2, 3, 4, 5, 6.

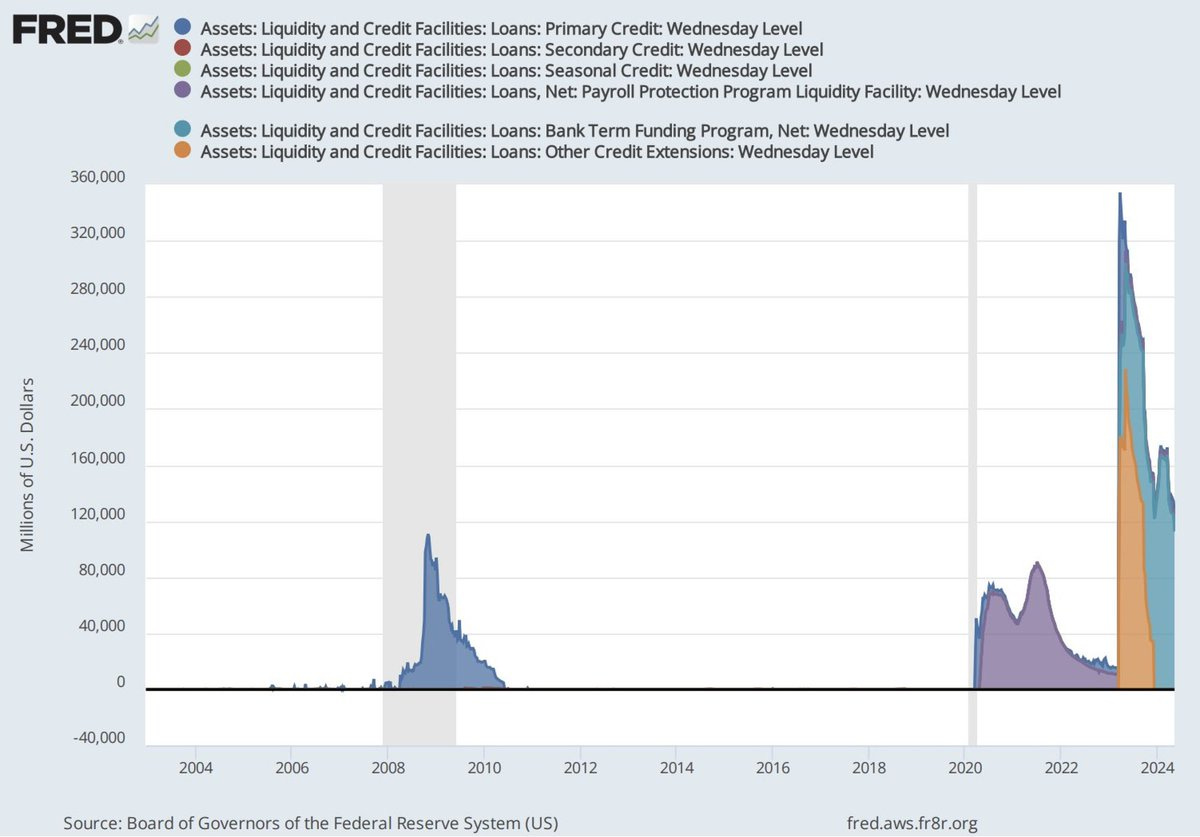

1) More emergency loans than 2008

First, did you know the Fed made more emergency loans in 2023 than during the financial crisis of 2008? The banking system is on life support thanks to the US government first selling billions in bonds to financial institutions and then devaluing them with surprise rate hikes.

Just look at this graph from the Fed. The blue bump below on the left is the lending from the global financial crisis of 2008 — you know, that little old thing! The purple bump is COVID. And the giant orange/aquamarine monster on the right is the 2023 banking crisis. See how much higher it is than even 2008?!?

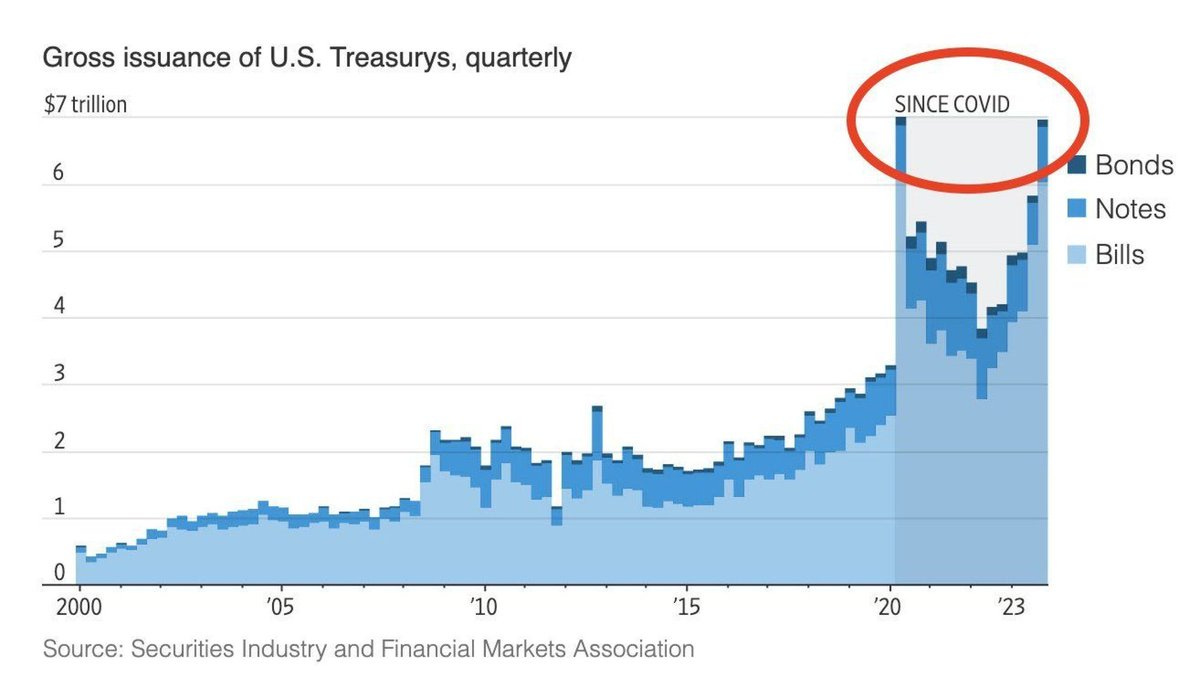

2) More borrowing than COVID

Second, did you know the US is borrowing more under the "Biden boom" than it did during COVID? Set aside whether a coronavirus should have been treated as a financial crisis. At least the COVID borrowing was at ~0% rates. But today the US government is borrowing historical sums of money in peacetime…and at 5% rates! This is the act of a desperate man maxing out his credit cards to pay his bills.

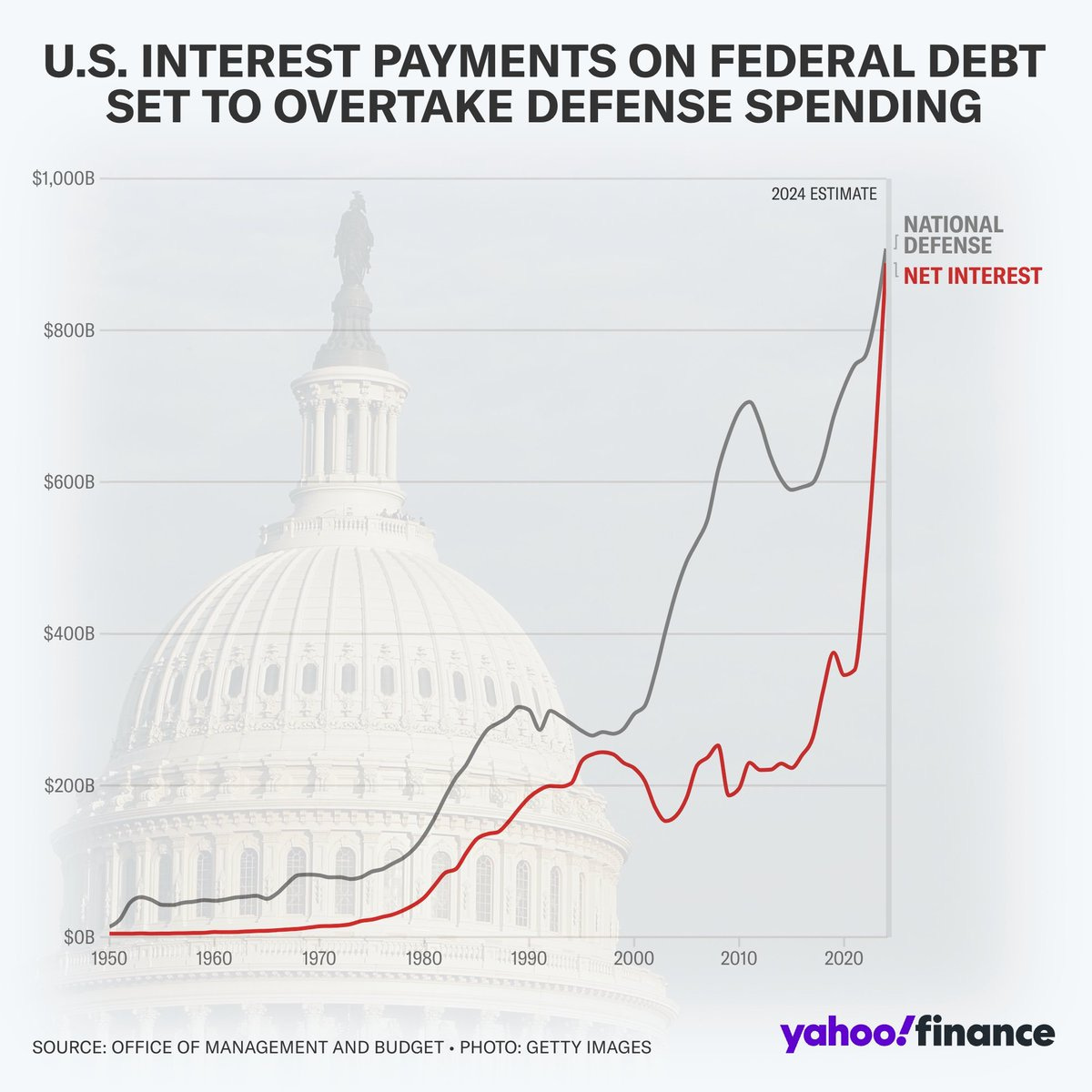

3) More interest than defense

Third, did you know that all this borrowing has made interest payments on the national debt the second largest government expense? More than defense, or Medicare, or anything else other than Social Security. Billions of tax dollars (and printed dollars) now go towards payments to bondholders. And even still, anyone who bought US Treasuries (or other bonds) got annihilated over the past few years. For all the warfare and all the welfare, it was buy now pay later.

And as you can see from the graph, the time to pay has come:

4) More devaluation of the dollar

Fourth, did you know that the dollar has lost at least 25% of its value in just four years? This one you probably knew from just your lived experience of inflation. But Larry Summers estimates that purchasing power has been eroded even more radically than this, with annual numbers hitting 18% if you include the enormous spike in loan payments due to rate hikes. Compounded over four years, that’d be easily more than 25% of the dollar's value.

Yet even 25% in four years is quite a lot:

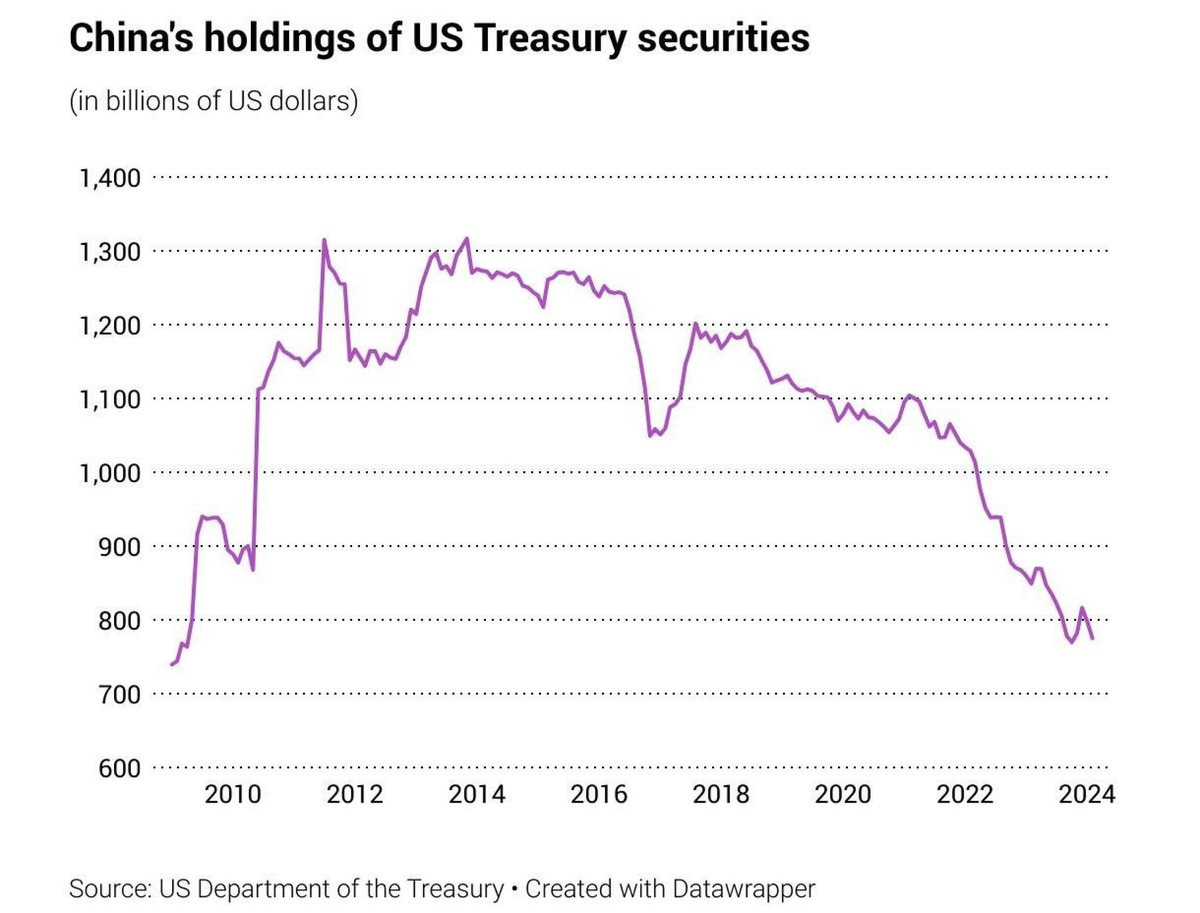

5) More treasury dumping by China

Next, did you know that China (the single largest foreign buyer of US Treasuries) has been dumping US paper at an accelerating clip? This is a bit technical, but China is an “outside investor” in the US kind of like a new venture capitalist investing in your tech company is an outside investor. Even by buying just 5% of your equity (or in this case, debt), they set the price for everyone else. And show that there’s robust outside demand, by people who don't have to buy.

But now that outside demand is crashing:

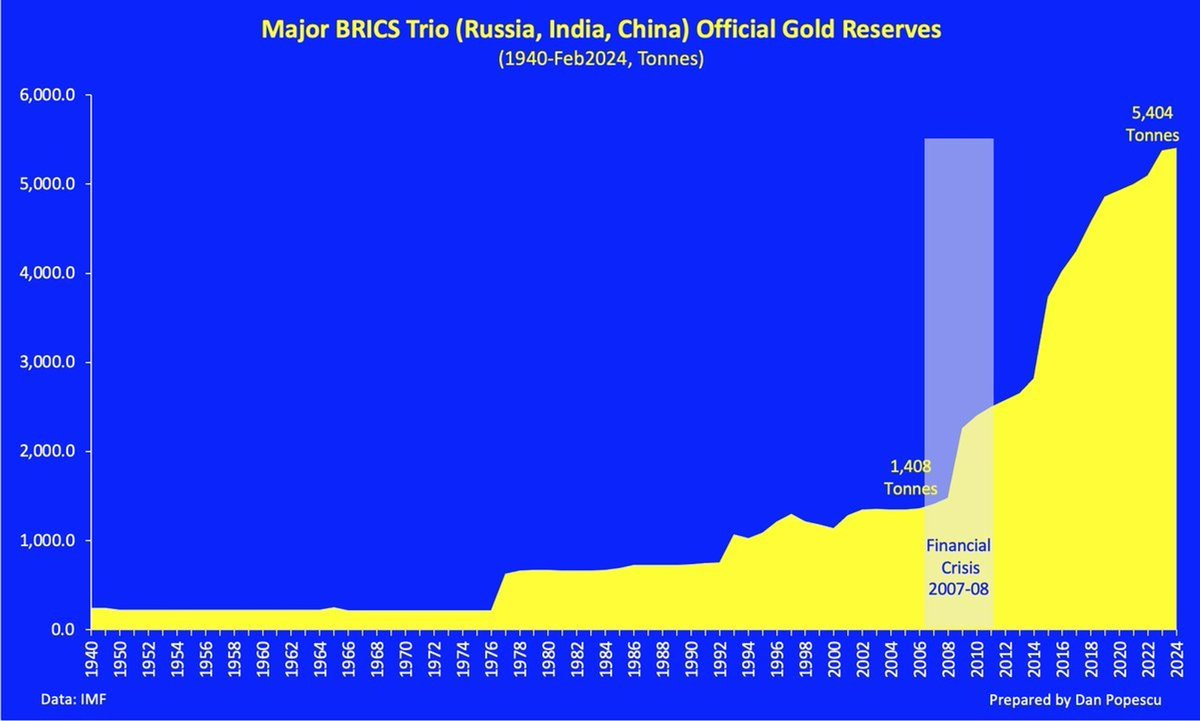

6) More gold buying by BRICS

But isn’t the dollar a store of value? What are other countries saving in if not US Treasuries? Well, China is a bellwether for much of the non-US world. And those countries have begun stacking historical quantities of gold, even as Western countries have been selling gold.

Take a look:

7) More de-dollarization than ever

Ok, what about the dollar as medium of exchange? Well, China — which is the #1 trade partner of most countries in the world now — has just flipped to majority CNY for cross-border foreign exchange deals:

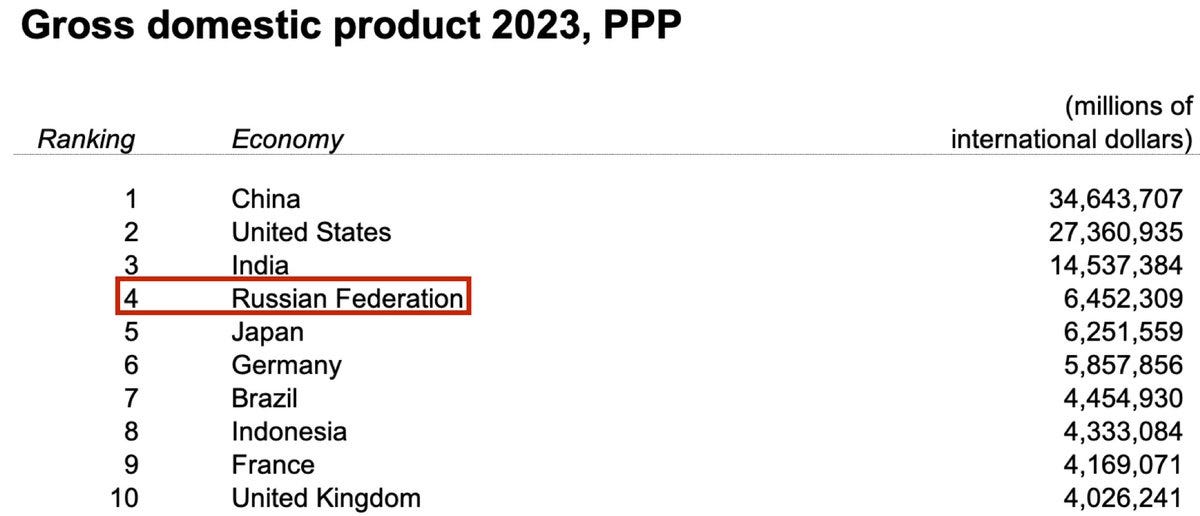

8) Less sanction efficiency than ever

Ok, but can’t the dollar still be used as a sanctions weapon? Don’t countries need access to the US financial system? Actually, no. All the sanctions on Russia actually ended up hurting Europe more than Russia. Europe needed Russia’s oil and gas, but Russia had other customers.

So according to the World Bank (not a Russian source!), Russia just flipped Japan to become the fourth largest global economy in GDP-by-PPP:

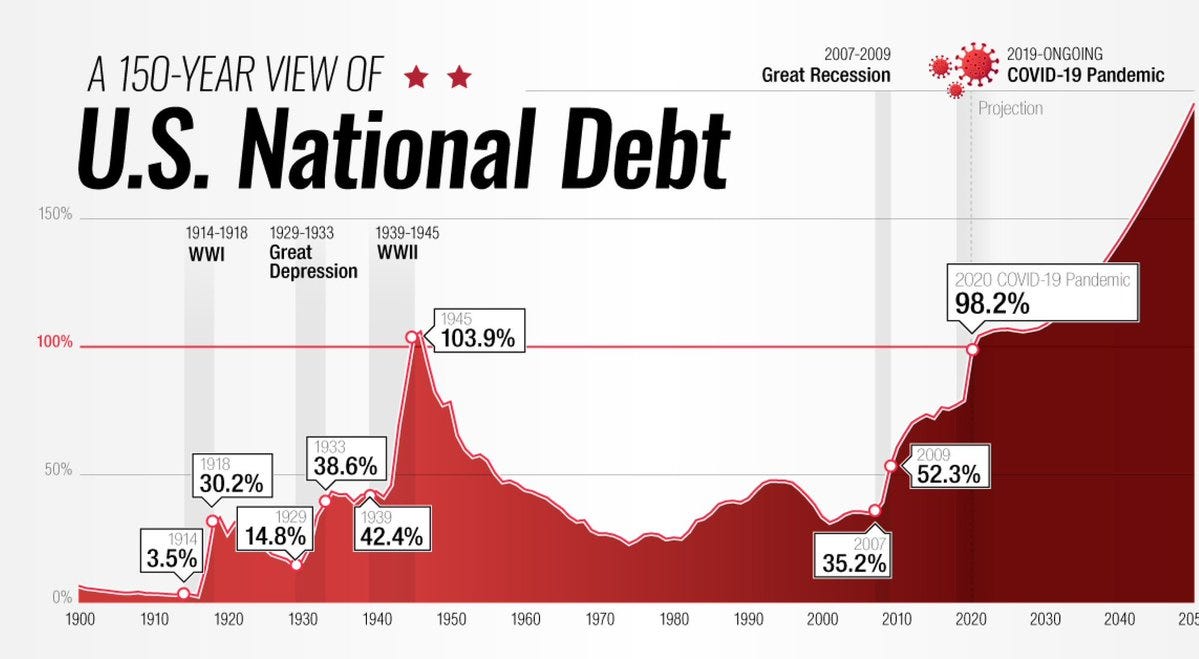

9) Peacetime debt approaching WW2

All right, but what about the US military? Can’t it ultimately go to war to protect the dollar? Well, that’s a much longer conversation, but see the graph below. Today the US is ostensibly in “peacetime."

And yet it has comparable debt to WW2:

This means the US has neither the money nor the manufacturing base for a sustained military campaign against a peer rival like China. You can’t fight your factory — especially when you’re out of money.

10) True debt more than any empire in history

Finally, maybe the single most important number is the $175.3T figure. That’s actually the true debt of the USA, when you take all the entitlements into account, like Social Security and Medicare. And that number is itself rapidly increasing. Don’t take it from me, take it from the Feb 2024 Financial Report of the United States Government.

That $175.3T lines up with the ~$200T number that Druckenmiller has been using for the all-in liabilities of the US government when you take everything into account. And of course, at this point we are in monopoly money territory, because:

The entire fedguv only collected ~$2T last year

That number is itself juiced by deficit spending

The dollar is down ~25% in real terms since 2020

And the "177T" in asset value plummets if liquidated

...or if there is a financial crisis, or both

So, that 175T debt is unpayable. And the US government doesn't have nearly enough to pay for what it owes. It's made promises to everyone, from allies to retirees, that it simply can't keep. To hang on to power amidst that web of broken obligations, it is going to get nasty on a level beyond which most can really comprehend.

See this post for more:

The US dollar is needed less, just when the US needs to borrow more

I really haven’t even gotten started. There are many more graphs I could show, many more videos from investors around the world from bonds to real estate who seeing what's happening. But: if you’re intellectually honest, you realize that the dollar’s position is rapidly eroding. It simply isn’t the indispensable asset it was. To summarize:

China doesn’t need the dollar to trade because they are using CNY instead of USD.

BRICS doesn’t need the dollar to save because they are buying gold instead of US bonds.

Russia doesn’t need the dollar to live because they are the fourth largest economy after being shut out of the US economy.

Yet the US needs as much of the world as possible to accept the dollar, as it’s borrowing at levels beyond COVID, beyond WW2, beyond any empire in history.

So, what comes next? I have some ideas, and you have some ideas. But first we need to align on what’s happening.

BONUS: Will AI solve this?

A popular line of thinking is that the economic gains from AI is gonna solve this problem. How do you respond to that?

I love the optimism. But let's do the math. As of late July 2024, here are the market caps of the top tech stocks:

AAPL: 3.4T

MSFT: 3.3T

NVDA: 3T

GOOG: 2.25T

AMZN: 1.67T

META: 1.25T

TSLA: 0.78T

So, the combined market cap of the Magnificent is "only" $15.65T. That's less than 10% of the $175.3T owed by DC! So, even if AI produces another Magnificent 7, there's no way to grow out of this. And by the way, it takes years to grow a trillion dollar company, years during which the US will just accumulate more debt at an accelerating clip. Everyone isn’t going to get what they’re owed.

A debt crisis is coming.

Great article.. According to you what would be a solution to this ever growing American debt?

What if the US gov adopts BTC to back USD? I think that would make it stronger and fiscally responsible ... at least for first step. Second step would be become energy independent by building as many as nuclear plant, this makes US slowly but surely could built anything cheaply + AI ... which in turn could make US strong in any sector slowly but surely ... and overtime earn respect in the internation community