All It Takes Is All You Got

Your assets are the government's collateral.

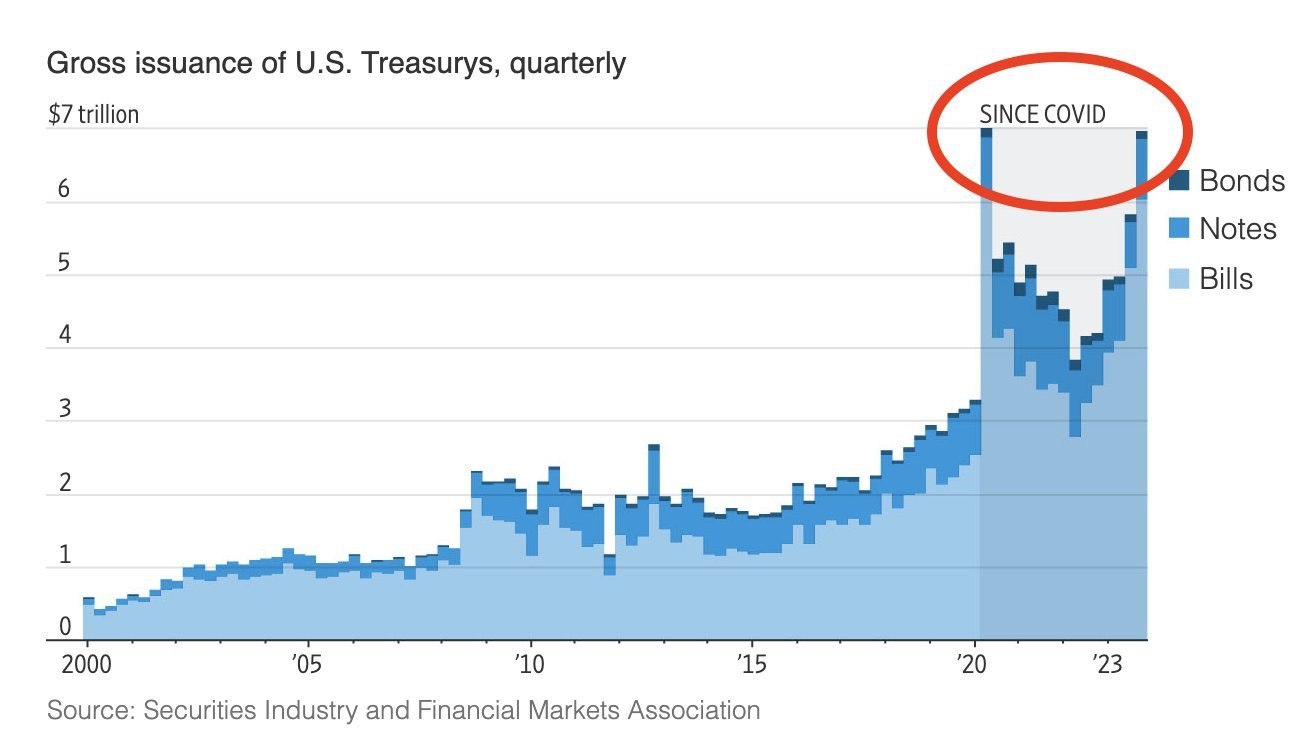

A recent Wall Street Journal article included this wonderful graph:

That’s weird. Why is the US government issuing Treasuries at emergency rates when the official narrative is that everything is fine? And why is the Wall Street Journal acknowledging something extremely strange is going on…and that it could end badly? Here are their words, emphasis mine:

Rapid growth in markets from tech stocks to mortgage bonds has ended badly in the past. Treasurys are considered the safest and easiest-to-trade securities on Wall Street, and many worry that any instability there could rapidly spread.

They’re understating it. When they say “ended badly”, they mean crisis.

2000 was the dotcom crash (“tech stocks”)

2008 was the financial crisis (“mortgage bonds”)

202X is the sovereign debt crisis

Moreover, in this one little quote WSJ also acknowledges that (a) there’s risk in the supposed “risk-free asset”, that (b) instability in the Treasury market is not only possible, but it could spread, and that (c) “many” worry about this. All this has of course been obvious for some time. But now with WSJ (and BlackRock!) starting to admit the debt is out of control, and that the “safest asset in the world” might actually end up being the riskiest asset in the world…normie finance guys have license to act.

II. The Big One

Thing is though…I hesitate to accept some of these parallels. What’s the right precedent for what’s coming? You can use the financial crisis progression of 2000 and 2008 and 202X, as WSJ implicitly did. But you can also put the events of 2001, 2008, and 2020 into a different crisis progression, as Summers did:

The COVID-19 crisis is the third major shock to the global system in the 21st century, following the 2001 terror attacks and the 2008 financial crisis.

We can organize these two different progressions in tabular form as follows, where WSJ’s is the middle row and Summers is the middle column:

Note first that 2001, 2008, and 2020 were each preceded by an “ignorable” event. The 1993 WTC bombings came before 9/11, the 2000 dotcom crash came before 2008, and the 2009 H1N1 pandemic came before COVID-19. Each of these were dots you could connect in retrospect, previews of the future for those who could extrapolate. But the magnitudes were wildly different. The world was changed by 2001, 2008, and 2020 in a way it just wasn’t by each of the predecessor events. (You could quantify this by sheer news coverage.)

Note next that as you go across, things get more severe. I’ve used the labels ignorable, decadal, and civilizational. An ignorable event is a news story that even someone who lived through at the time might not have registered. A decadal event is something that shaped the decade. And a civilizational event? We haven’t had one of those in a while.

It’s going across — from ignorable, to decadal, to civilizational — that concerns me. I don’t know if we’ll see a nuclear 9/11, or a pandemic that’s much worse than COVID-19.1 But I do think, like Ray Dalio, Stanley Druckenmiller, and Larry Fink that we are headed for sovereign debt crisis.

And so comparing 2008 to what is coming may give a false sense of security. What if the coming sovereign debt crisis is to the mortgage crisis as COVID-19 was to H1N1? What if it’s just so much bigger that it’s like comparing a small war to a world war?

Because that’s Dalio’s thesis. That a sovereign debt crisis will mean a changing world order.

III. What about the assets, huh?

Ok, ok. Let’s not get ahead of ourselves. If I represent the “it’s happening” faction, it’s always worth hearing the rebuttal is from the “nothing ever happens” faction.

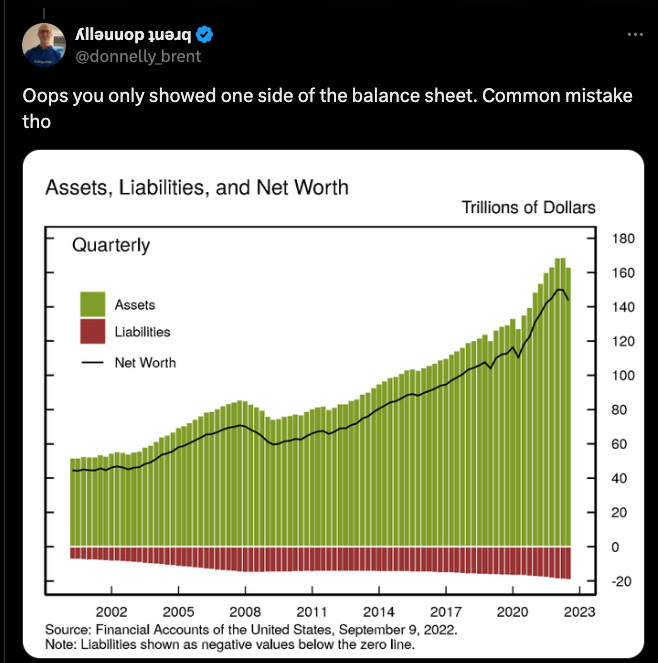

Here I am saying the economy isn’t real, it’s propped up by record debt, and they will fake it till they break it. That would indeed be a happening. And lo, here comes occasional Twitter sparring partner Brent Donnelly, to explain why nothing will happen.

Checkmate, right?

IV. All It Takes Is All You Got

I actually really loved this response so much.

First, the debt didn't matter.

Now, it still doesn't matter...

Because the state can take all your assets to pay it!

Here's that graph Brent cites again:

Below is the same graph with titles and labels. See how it says balance sheet of households and nonprofit organizations? So that $177T number isn't really about government assets. It's everything every American household (and nonprofit, hedge fund, PE fund, and personal trust) owns.2

And now we're getting down to brass tacks.

See, Keynesianism is like Communism in that it sees no real difference between household and government assets. They recognize no moral limit on how much they can take from the population via inflation and seizure, only practical limits.

If you doubt this, ask a Keynesian if they would accept any hard limit on the money supply or upper bound on the tax rate. They won’t. And this is why they print trillions yet keep proposing “wealth taxes.” The implication is that every dollar can be diluted and every possession can be confiscated, if only the state can finagle some legal basis for it. Ideally via a 1000-page omnibus bill rammed through in the early hours over protest. The point being: your household assets will be taken to pay for what this failed state owes.

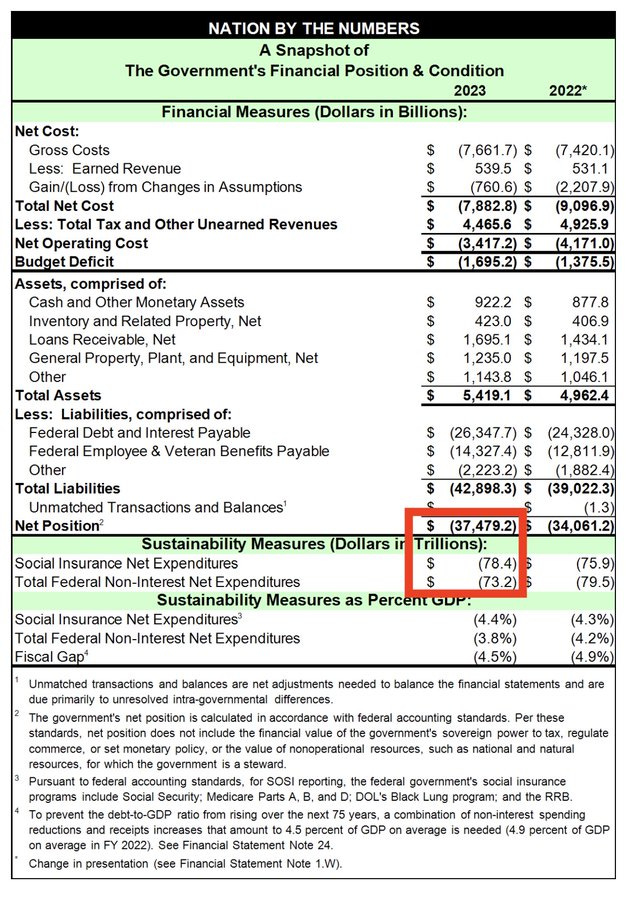

And how much does it owe? Well for that we can go to a recent analysis of the Feb 2024 Financial Report of the United States Government. Here's the table where the US government itself admits that even $37T is an underestimate of the debt. When you include the "social insurance" of Social Security and Medicare it's another $78.4T line item:

But wait, there's more!

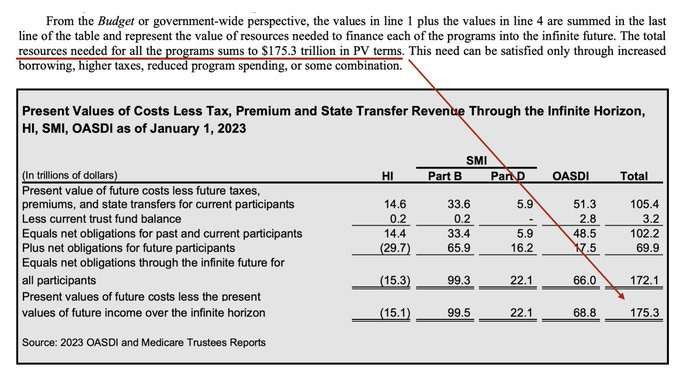

Later in the doc Treasury itself admits even *this* is a sharp underestimate of what the US owes in terms of Social Security and Medicare because it's not accounting for future payouts decades from now. Once it does, what does the number get to? Here's the direct quote from them: "The total...sums to $175.3 trillion in PV terms. This need can be satisfied only through increased borrowing, higher taxes, reduced program spending, or some combination."

That $175.3T lines up with the ~$200T number that Druckenmiller has been using for the all-in liabilities of the US government when you take everything into account. And of course, at this point we are in monopoly money territory, because:

The entire fedguv only collected $1.86T last year

That number is itself juiced by deficit spending

The dollar is down ~25% in real terms since 20203

And the "177T" in asset value plummets if liquidated

...or if there is a financial crisis, or both

So: no, the US government doesn't have nearly enough to pay for what it owes. It's made promises to everyone, from allies to retirees, that it simply can't keep. To hang on to power amidst that web of broken obligations, it is going to get nasty on a level beyond which most can really comprehend.

I appreciate, however, that we are starting to glimpse the endgame. When a bankrupt state collapses, it's like a black hole. It sucks everything it can into its gaping maw. Everything it can possibly seize, will be seized. Everything it can possibly print, will be printed.

All your assets become its assets.

All it takes...is all you got.

There was a report of Chinese scientists experimenting with a more lethal COVID-19, but evidently it only works in a certain transgenic mice strain (?) I agree with the scientists quoted here that we shouldn’t play with fire here.

This $177T isn't cash, of course. If you actually sold all those assets (to who?! for what?!?) they would crash in value. Google itself is only worth <$2T! So if we're actually talking about that $177T as "collateral" against the $200T owed by the US government, which means welfare payments and medical care for seniors — we're talking about a bizarre end-of-the-Soviet-Union fire sale here, combined with a beginning-of-the-Soviet-Union asset seizure.

There are ways out, though we don't see the intestinal fortitude inside politicians to go the route they need to go.

First, as Professor John Cochrane (The Grumpy Economist) notes, why are we taxing income and not consumption? We can easily track consumption. Getting rid of all federal taxes and instituting one simple consumption tax would be hyper efficient and generate more tax revenue than we do currently. (FairTax.org; get behind it and tweet about it)

Second, we need to make a deal with US citizens. Means testing Social Security is one option. Why does Bill Gates need it? Second, we need to end the program. That means picking an age and telling anyone under that age they won't be getting it-but they don't have to pay into the program either. Next, maybe offering a net present value payout to existing SS recipients. Corporations did this with defined benefit pensions in the 80s and 90s.

Medicare is a different animal. Underlying that problem is that the entire health system market in the US is screwed up because of regulation and mandates. Even the American Medical Association regulates how many doctors can go into certain specialties, and where hospitals can be built. The insurance market for healthcare is dominated by two to three companies. The answer is to deregulate and provide a playing field that has intense competition. Once you do that you can start to see what Medicare might look like, and the answer to that problem.

Fortunately, there is a school choice movement and we need to embrace it. There are better ways to educate our children than the US public school system. It has become the industrialized education complex and it serves its bureaucracy and not the kids. With technological advances, it is antique, brittle and doesn't work anymore.

Getting rid of a lot of the transfer payments and welfare programs is also a good idea. The world does need ditch diggers and too many people in the US survive off of working the government system. It's not that they aren't smart, they are smart. Navigating government bureaucracy is hard. Tied in with that is getting rid of a lot of employment regulation and mandates.

As Robert Bryce shows, economies with the most access to cheap energy do better. That means nuclear power and fossil fuels. Solar/Wind all this green energy bullcrap need to go by the wayside. They might be okay in decentralized single use situations but they cannot power an on demand information economy.

We have spent trillions on getting rid of poverty to no avail. Our cities are a mess. You can say, "the US is $200 trillion in debt" but now add in state, county, and city debt. It's a gigantic wall of debt that seems insurmountable.

Only economic growth, and massive cuts in government spending change that picture. The only way to do that is through capitalistic free market free enterprise competition. These are not problems that are insurmountable. They are problems that take guts to take on given the current political environment.

The US is not like the US I grew up in. It looks very much like the thing we didn't want which was a socialized European bureaucracy.

There is a book out call the Great Taking. Pretty interesting stuff. While "legally" they would empty your bank account as you are an unsecured creditor to your bank when you make a deposit and are last in line to get your money back from the bank. In normal times you just get your money back from the takeover bank or FDIC, but not from the bank. In brokerage accounts it is the same. All your assets are held in street name, meaning your broker holds all your stock positions on its books legally. When you get your statement, the broker has allocated your portion of its APPL holdings to your account. You are the beneficial owner but not the legal owner.

The issue I have with the whole taking concept, is to what end? What would be left? So they take all your Apple stock. What would it be worth if the entire world economy is destroyed and the US was no longer a consumer country? Maybe not zero, but damn close! The entire economy would cease to function. So they take everything from you to pay the debts but the whole thing collapses into a pile of rubble anyway.

Remember, though in 1933, Roosevelt confiscated all gold from the American people and devalued the $ by 75%. The dollar was about $20/oz up until that time, then after the "revaluation" the dollar was pegged at about $35 per oz where it stayed until 1971 when Nixon closed the gold window and stopped France from redeeming there overseas dollars for gold.

So what does this all mean? Yes the financial system is in trouble, but my guess is they have a very big tweek that somehow avoids a collapse. My pet theory is that when a market crash comes, they will offer to make your retirement funds whole, but only if you turn them over to the gov for use to make social security appear solid.

This is all wild conjecture. My entire adult life, "they" have been screaming about the debt and deficit. All the way back to Reagan when the national debt was $1T. So far, the masters of the universe have staved off Armageddon. Let's hope they can do the same for another 40 years as nobody alive today is prepared for what the failure world would look like. The how do you position for this type question is meaningless as the entire financial system of the world would never be the same.