No Cap

The Fed's new self-bailout program apparently has no upper limit.

You know how Bitcoin maximalists write ♾ / 21M to describe the idea that fiat is infinite but Bitcoin’s supply is capped at 21M? A better name for the BTFP might be ♾ + 25B.

As context, the Fed rolled out the so-called Bank Term Funding Program (BTFP) in March 2023 after a wave of bank failures that the Fed itself caused by devaluing bonds. Think of it as a self-bailout, where the central bank is printing money to cover up its own disaster.

Thing is, the full scale of the program has been reported confusingly. Is it $25B, $2T, or even $18T? I recognize that we’re at the end of empire, where numbers don’t matter and trillion dollar coins have no inflationary effect, but given that this may be the start of the largest self-bailout in history, I dug in. My conclusion is that it’s apparently uncapped.

Fed lied, banks died

First, as background (and this honestly can’t be said enough)…remember that the government sold hundreds of billions of dollars worth of bonds to banks in 2021, while telling them interest rates would be kept near zero indefinitely.

It then promptly devalued the assets it had just sold by hiking rates to the moon in 2022, causing massive unrealized losses for all bondholders. This is what led to the banking crisis of early 2023, when some of those losses suddenly became “realized” because depositors (not unreasonably) asked for the money in their checking accounts.

So: Fed lied, banks died. The Fed lied about keeping rates low, and banks died because they had bought bonds on the basis of those lies.

And as internal documents show, people at both Fed and FDIC knew that hundreds of banks had been rendered practically insolvent by their rate hikes, perhaps even most banks…but they didn’t tell you — the depositors.

Instead, only when banks started publicly dying from bank runs (something Fed officials said was impossible), did the Fed implement a self-bailout program called BTFP to try to hide what it had done. And it hid1 the full scale of the damage in legalese on its website.

BTFP = ♾ + $25B

Take a look at the primary documents. Here's the official BTFP website, the initial announcement, the FAQ, and some of the initial press coverage. As you read through all of that, it amounts to ♾ + $25B.

♾ is the size of the self-bailout. It’s the amount the Fed may loan to banks via BTFP to compensate them for the losses the Fed itself caused. We call it ♾ because there isn’t any published cap on the Fed’s BTFP website.

$25B is the relatively small backstop. This money is from Treasury and used in the event that the collateral pledged by these banks falls2 in value. It’s the only hard number in the program description on the Fed’s website, but it’s essentially a MacGuffin, meant to throw you off about the seemingly uncapped size of the BTFP program.

So, what’s the size of BTFP right now? From the Fed's own grudgingly published numbers (1, 2, 3, 4), the program is already up to $107B+ as of May 31, 2023.

How big could it get? This article reports $2T, which is similar to the $2.2T figure for unrealized losses estimated by this Stanford study.

And what if the Fed goes so far as to self-bailout all the banks the Fed itself wrecked with rate hikes? Then the combination of BTFP and the as-yet-unnamed but informally designated “FedDIC” could even be $18T.

But I think the main take home to me is that there’s no apparent cap on BTFP. At least, I couldn't find one. Maybe you can. To ♾, and beyond!

Appendix

Tweets

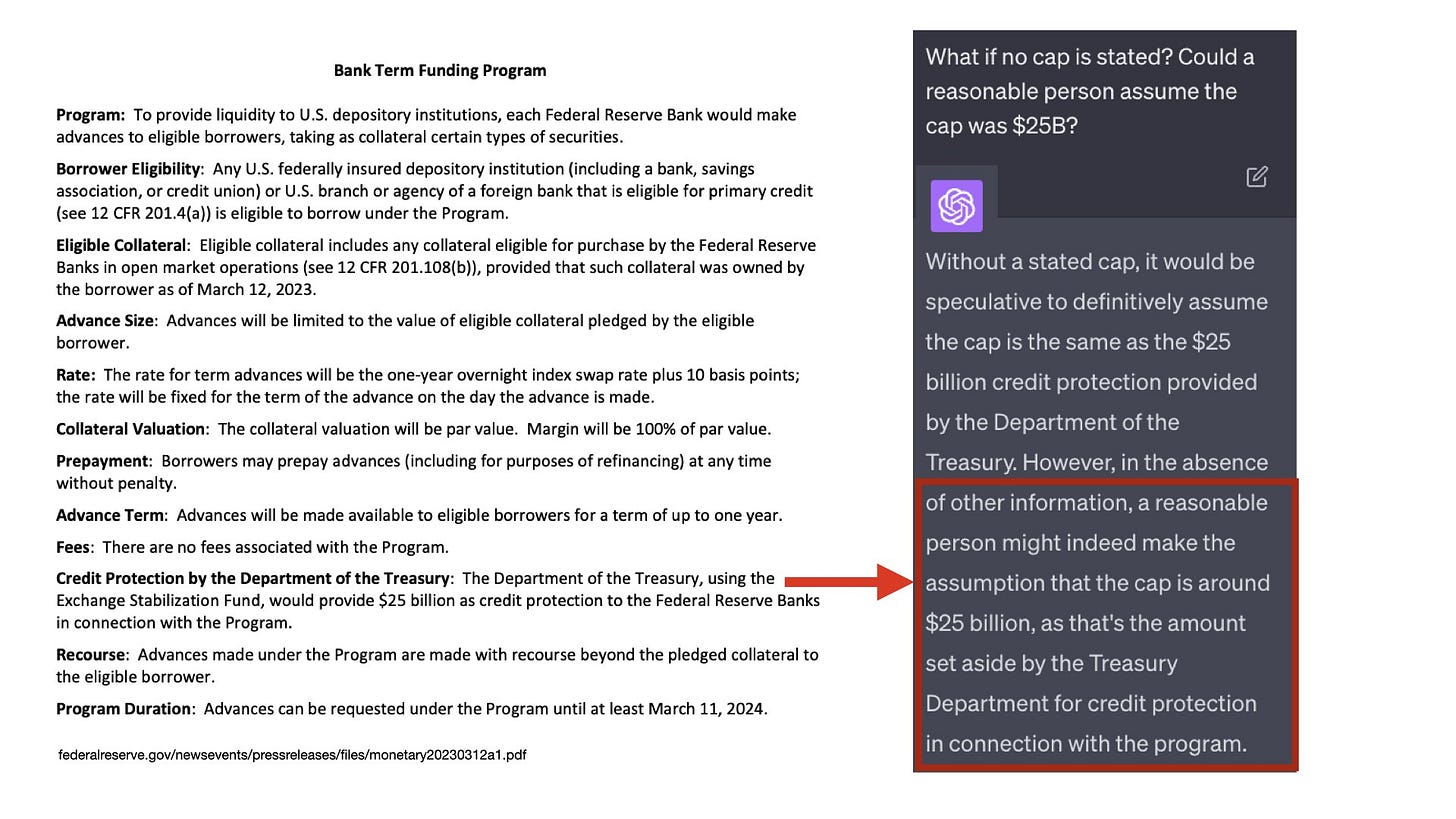

Here’s a thread with some fun followup tweets. Just as a sanity check, I fed the original BTFP terms into ChatGPT and asked what a reasonable person might assume about the program. And it also came back with a $25B cap.

Further Reading

For related perspectives, here’s Arthur Hayes on BTFP and Ray Dalio on how bonds caused the crisis.

As you can see from this headline and other sources, the Fed managed to mislead reporters at multiple outlets into thinking this was a $25B program. The level of evolved opacity in the financial system is truly incredible…

It feels silly to even take this stuff seriously, because these are all funny money loans on an incalculable scale. For example, the “value” of the BTFP collateral is set by the Fed’s own policies, so it’s not like some uncertain thing as to what the value is going to be. And the BTFP program can be turned from a 1-year loan into an indefinite loan by the flick of a pen. And so on.

Hey @balaji

This seems big! I have a few questions:

1. Looks like they've printed 1/5 of btc market cap. And it seems like crypto in general surges with bailout/printing events. Cyou say there's a correlation here?

2. 700+ banks sounds massive! My bank could directly or indirectly be on that list. Is it better to hold stable coins vs keeping cash in bank?

3. Why isn't the economy not crashing with this many banks reporting high losses? 50%+ is crazy! Is this a "slowly then suddenly" event? I'd expect mainstream to be all over this. Bank runs and massive inflation as a result of the printing.

Or perhaps we're a few months early?

Awesome post!