Too Fake to Tell

US government stats aren't reliable. More importantly, neither are US government bonds.

The other day, David Sacks made an offhand tweet:

And people lost their minds. How dare you question the integrity of US government statistics, especially by comparing the official numbers to your unscientific personal observations! Why, you’re saying the US establishment can’t be trusted on faith. I mean, that’s nihilism…that’s anti-American…that’s an attack on civil servants! And that’s…also now the supermajority opinion of most Americans and indeed much of the world?!? Indeed it is:

Yeah. After decades of betrayal on the most high-profile assertions — the ones where people put in the energy to verify the claims — Americans have decided that whatever they hear from the US establishment needs to be taken with a huge grain of salt. And the operative term there is “US establishment”, because the vast majority of Americans now distrust not just their formal government, but the array of professors, nonprofits, and journalists that make up the informal establishment. For example:

So, with this merited background level of distrust in mind, let’s first talk about the jobs data, specifically, and why something that we shouldn’t put much stock in is being used to guide the Fed’s decisions (which everyone has a stock in).

Then let’s move on to the trust issue more generally, giving more than a dozen examples of economic fakery that establish the baseline for what we can expect from the US financial system.

Next, we’ll shift from the relatively unimportant jobs report to perhaps the most important ongoing abuse of economic trust in the world: namely, the rug-pull that the US government executed on all those who bought Treasuries in 2021.

In a subsequent post, after enumerating how all those who trusted the US government in 2021 by buying Treasuries have gotten completely wrecked, we’ll talk about what can be done from both a technical and political standpoint in the aftermath to rebuild trust.

The Jobs Data, Specifically

Do I really care about the May 2023 BLS jobs report? No, this is the kind of government ephemera you can waste1 endless brain cells on. But let’s drill in anyway as an exercise.

First, the jobs data was heralded as “crushing expectations.”

Then, Sacks and I raised some questions, particularly on the jobs data beating expectations 14 times in a row.

Soon, a bunch of US government loyalists started saying that of course the data isn’t wrong and how dare we nihilistically accuse brave civil servants of being in error…

But after a back and forth, it was acknowledged that (a) BLS has indeed made major revisions to other data, (b) the LinkedIn data shows a significant decrease in hiring rate year-over-year, (c) the unemployment data was in fact mixed enough to get the Fed to skip a rate hike, and (d) most importantly as my old friend Noah Smith writes:

…it’s just really hard to get accurate real-time data on something as complex as a country’s job market, which is why we shouldn’t put too much stock in any one month or even one quarter of data.

Couldn’t have said it better myself!

And since Noah wrote his piece with input from some of the finest fiat faithful, we can assume this represents the consensus opinion of the dollar nationalists: that we shouldn’t put too much stock in the unemployment data on a real-time basis.

Yet if that’s so, why are all the headlines using that data to say that the “resilient labor market" is "crushing expectations" and “much better than expected” with the "economy still going strong"? Shouldn’t the mainstream narrative be a bit more circumspect?

And if the real-time unemployment data is admittedly unreliable…why is the Fed using it to steer interest rates — and hence the entire economy — on a real-time basis?

Why is the Fed using unreliable unemployment data to set rates?

Because here’s the thing: the unemployment data that we all now agree we shouldn’t put too much stock in is a key input to the Fed’s interest rate decisions, which affect the entire world economy, something that people kinda do put a lot of stock in — including all their stocks. Take it from the Fed themselves:

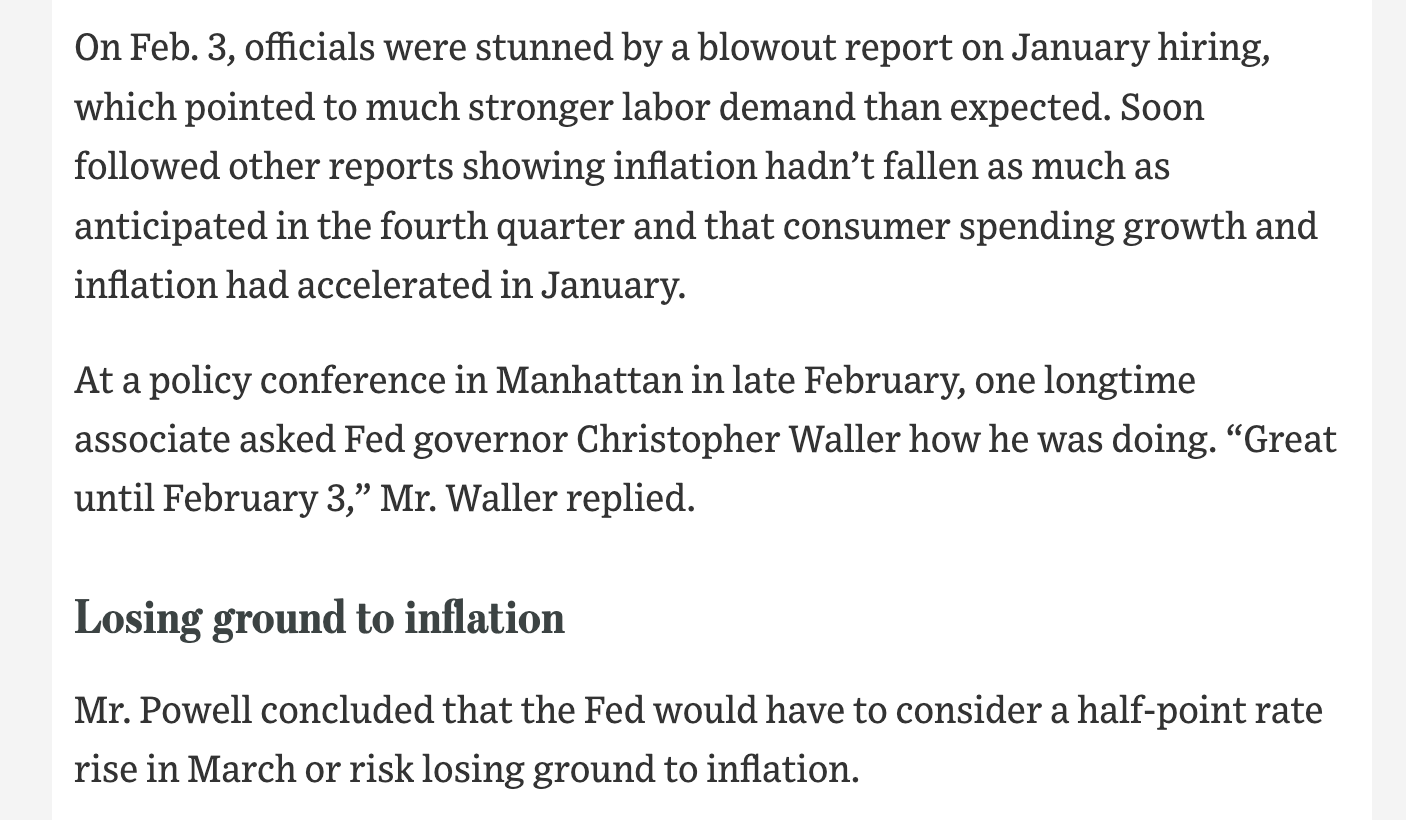

He was doing “great until February 3”! Then, officials were “stunned” by the jobs report and immediately shifted their decision making in real-time…despite the fiat folk just agreeing that the unemployment numbers aren’t reliable in real-time.

So it’s garbage-in, garbage-out. That means the Fed is making (at best) extremely imperfect decisions on extremely imperfect data. But they’re not going to stop doing so on the basis of a little Twitter contretemps over unemployment data. In fact, in a few weeks, everyone will forget this happened, like Gell-Mann amnesia, but for data. And the Fed will continue using the (now-admitted-to-be-unreliable!) unemployment data as part of their data-dependent policy path, which means making it up as they go along in response to the unemployment headlines of the day.

So should we really “trust the process”?

The Trust Issue, Generally

And this gets to the trust issue, more generally.

Because digital glasnost is upon us. We now have truly free speech. And so millions of people have now been able to match up their individual observations with each other in public, thereby discovering that much of what the US establishment says is manipulated, misleading, or erroneous in some fashion — in a word, fake.

Of course that doesn’t mean the US establishment is always lying. Sometimes they’re in error. Sometimes their data is merely noisy, or quietly revised. Sometimes they are telling the truth, but spinning it. Sometimes they are taking a position for tribal political reasons. And sometimes they are, of course, outright faking it.

A quick tour of specifics will make the point.

Here’s Bernanke talking about how the “Great Moderation” means we’ve tamed macroeconomic volatility, three years before the financial crisis

Here’s Cheney around the same time saying deficits don’t matter

Here’s Bush and Clinton helping blow up the mortgage bubble in a bipartisan way

Here’s Bernanke in April 2008 saying that we might see a “mild” recession, five months before the collapse of Lehman

Here are the rating agencies in 2008 calling subprime mortgages AAA, before the collapse of the global economy

Here’s the administration in 2011 retaliating against S&P for downgrading US debt, showing another reason why the ratings agencies marked everything AAA

Here’s Bernanke in the early 2010s saying QE isn’t money printing, and then Powell more recently admitting that it was

Here’s Greenspan in 2011 saying that the US can never default…because it can just print money to monetize its debts

Here are the erroneous projections of unemployment rates as a function of stimulus vs the actual rate, showing how poor macroeconomics is at forecasting the macroeconomy

Here’s Yellen in 2013 reported as being aware that the housing crisis was happening, but not sounding the alarm for the public

Here’s Yellen saying there will not be another financial crisis in our lifetimes

Here’s Powell through 2021 insisting that inflation wasn’t a risk, before hiking rates to the moon

Here’s Kashkari saying rates would be held near zero for years, again before massive hikes

Here’s Cohn in Nov 2022 saying that the public has more faith in the banks than the FDIC committee does

Here’s Powell in March 2023 saying US banks have strong capital, three days before the banking crisis started

Here’s Barr in March 2023 saying the banks they regulate are well protected from bank runs, on the morning that the bank runs started

Here’s Biden in 2023 saying that the US has never defaulted, though it has done so multiple times

Here’s both Trump and Biden reversing their positions on the debt ceiling

Here’s BLS in Q4 2022 saying hourly compensation rose 4.9%, which was an input to the Fed’s decisions, before they revised it a few months later to say actually that hourly compensation fell by 0.7% — the kind of revision that’d be a huge deal for any company

And here’s Krugman from a few weeks ago saying that minting a trillion dollar coin wouldn’t be inflationary, but it’s a little too understandable, so let’s call it premium bonds instead because they’re “harder to explain”, thereby allowing the US establishment to fool the rubes

That’s twenty years of economic fakery, just off the top of my head. It’s a mix of error, revision, spin, tribalism, pseudoscience, and outright fraud.

The projection of the stimulus impact was in part error

BLS revising its hourly comp data was a (very material) revision

“QE isn’t printing” was spin

“Debt ceiling does/doesn’t matter” was tribalism

The “Great Moderation” was Keynesian pseudoscience

The AAA-rated mortgage-backed securities were outright fraud

And “transitory inflation” was a combination of all of the above — error in forecasting, revisionary history to pretend that the Fed had “telegraphed” rate hikes, spin to argue that “everyone” had it wrong when only the establishment did, tribalism to argue that inflation assertions were “right-wing” fearmongering, Keynesian pseudoscience to believe that the zombie economy of late 2021 could tolerate the kind of rate hikes that Volcker executed 40 years ago, and an outright fraud perpetrated on every unfortunate who bought Treasuries in 2021.

Wait, fraud? By the US government? You may not have heard about that. So let’s explain.

Trust the Fed, End up Dead

I mentioned that I don’t really care about the jobs report that much. So what do I care about? I care about the fact that the Treasury + Fed (which we shall abbreviate as the US government)2 abused everyone’s trust by (a) selling hundreds of billions of dollars worth of bonds in 2021 on the pretense that interest rates would be held near zero and then (b) mass devaluing them in 2022 with surprise rate hikes, setting the stage for (c) not just the ongoing banking crisis but a crisis of the Western financial system itself.

If you want an analogy for what happened, imagine that Apple told Best Buy, Target, and Walmart that it was only going to be selling iPhone 10s for the indefinite future, and sold them billions of dollars worth of phones on the basis of that representation. Then after selling those billions, it turned around and launched the iPhone 11 — suddenly devaluing all the inventory it had just sold, and forcing Best Buy, Target, and Walmart to sell their billions of now-depreciated iPhone 10s for a 10-20% loss…small in percentage terms, but massive when multiplied across that much inventory, especially for something they didn’t expect to take a loss on. Had Apple done this — had it committed to not launching a new phone in writing to its buyers, and then reneged on that promise after dumping billions in old inventory on them, we’d call that fraud. Apple would have sold those assets on false representations, regardless of whether they knew they were going to devalue the assets at the time of sale.

Now, Apple probably wouldn’t do that! But that’s what the Treasury and Fed did to their banks in mid-2021. They sold billions of dollars worth of bonds at low interest rates, telling the banks over and over and over again that inflation was transitory and that they wouldn’t hike rates. Banks reluctantly “binged” on those bonds, and then — surprise! — the Fed hiked rates to the moon. And Treasury began selling new bonds with much higher interest rates, like the iPhone 11s in our analogy, thereby devaluing everything the government had just sold.

Whether intentionally or not, consciously or not, the US government executed the mother of all rug pulls on its own banks (and other financial institutions). Like Stalin killing his most loyal communists, Powell killed his most loyal capitalists, the biggest buyers of Treasuries. This is exactly what we’re talking about here, an enormous abuse of trust.

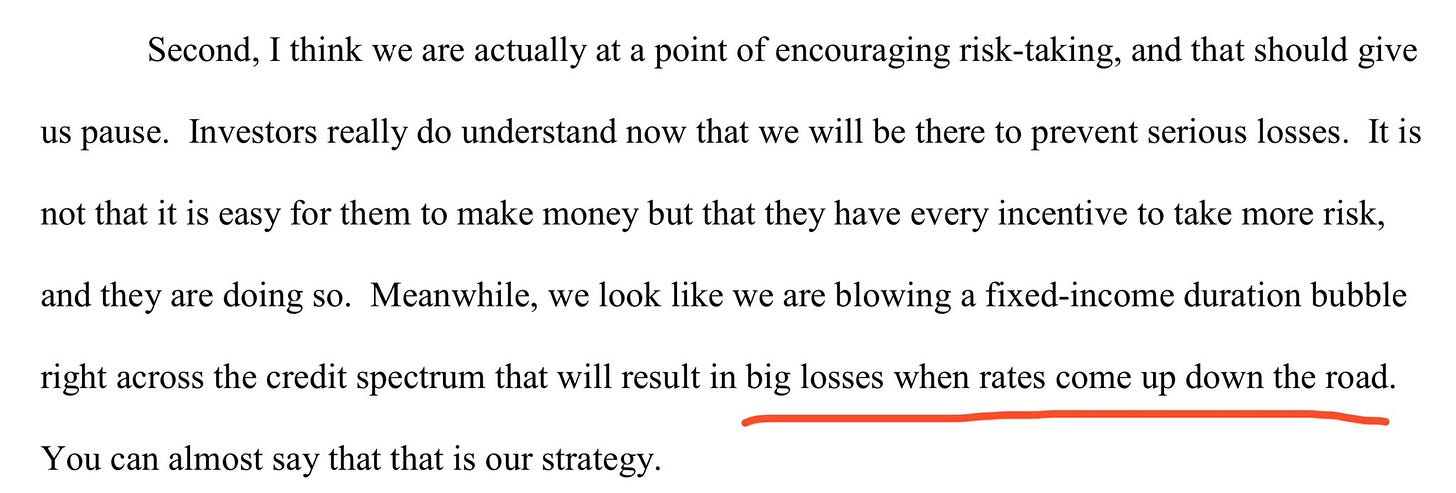

Because there is at least some evidence that Powell was aware of what he was doing, at least judging from his remarks on page 193 of these minutes from 2012:

“That is our strategy” — to sell a bunch of bonds and then devalue them when rates come up, causing “big losses.”

Treasuries are the new Toxic Waste

But wait, did this really happen? Don’t take my word for it. Here’s billionaire investor Ray Dalio:

“It's not [just] a banking issue. It is a global issue...all sorts of entities, pension funds, insurance companies, all around the world...there was a lot of buying of these government bonds. Which have gone down in value...”

Here’s Euromoney:

“US Treasury bonds no longer meet the standards for high quality liquid assets.”

Here’s the Guardian:

"ask whether we are on the brink of another global financial crisis.…banks’ unrealised losses on their bond portfolios are sufficiently large as to represent a systemic risk and therefore require an extraordinary policy response…”

And here’s Nouriel Roubini:

“10-year Treasurys lost more value (-20%) than the S&P 500…and anyone with long-duration fixed-income assets denominated in U.S. dollars…was left holding the bag.”

I mean, you get the picture. These aren’t tech guys, these aren’t Bitcoin guys. These are tradfi guys, of different stripes. And there are many more references in this video, in this migrated blog post, and in this podcast.

But just think about what they’re saying:

10-year Treasuries are massively down

So Treasury bonds no longer meet the standards for high-quality liquid assets

And all sorts of entities bought these bonds

So the unrealized losses on bonds represent a systemic risk

“Systemic risk”. You should have a sinking feeling if you process the implications.

Because everyone is taught in school that US Treasuries offer a “risk-free rate of return”, that they’re the “safest asset in the world”, and that the US government cannot default on its debt. And if you’re running a bank, you’re also encouraged by regulations to hold “high quality liquid assets” like Treasuries. They are the bedrock of the global financial system. And they are failing.

That’s why I am a bit impatient when people first insist that you MUST trust the jobs report, and then fall back to “OK, you shouldn’t put too much stock in it on a quarter-to-quarter basis.”

Forget about trusting the jobs report! We can’t trust the US financial system as a whole. The US establishment has bankrupted its own financial institutions, devalued its bedrock asset of Treasuries, and generally suppressed clear discussion of the entire matter in favor of blaming the institutions that were gullible3 enough to buy US government bonds and the depositors that were credulous4 enough to store money in US-regulated banks.

Again, go look at Dalio (full interview), Roubini, Euromoney (full article), and the Guardian to check and triangulate what I’m saying.

Then check back for part 2: what can we do?

There are so many ways to juke unemployment stats that discussing this stuff is like obsessing over the score of a random game of Nomic in a foreign country with an unfair referee. They can change the rules at any time, silently, so you have to really dig in and treat the process as adversarial diligence.

Technically, Treasury issued the bonds and the Fed hiked the rates, but as even Krugman acknowledges they can be considered a unitary entity for many purposes, and certainly Treasury and Fed do closely coordinate with each other. Hence, we say that the “US government sold assets by the billion that it then devalued”, with one arm (Treasury) doing (most of) the selling of assets and the other arm (Fed) doing the devaluing.

Many folks say that the institutions who bought these long-term bonds in 2021 were dumb, and should somehow have been aware of “duration risk” and “hedged”. But for a variety of reasons that wasn’t realistic.

First, the sheer scale of the bond purchases (this study estimates $2.2 trillion in losses) across the entire financial system meant there weren’t liquid counterparties to hedge against.

Second, as banks tried to hide their losses, any assets they moved into the so-called “hold to maturity” column couldn’t easily be hedged due to accounting rules.

Third, you can maybe hedge interest rate risk if you buy a bond at 1% and forecast an interest rate of say 0.8 to 1.2%. But hedging isn’t magic. If the rate instead suddenly hits (say) 5%, it would be far outside expectations and potentially impossible to hedge.

Fourth, the entire financial system was being told that inflation was a right-wing conspiracy theory and that it hadn’t happened from 2008-2020, so it wasn’t politically feasible to aggressively hedge against the Fed. The kinds of people buying bonds by the truckload in 2021 were disproportionately conformists, as most of the rebel DNA had already left to fintech or crypto.

Fifth, even as late as November 2021, the Fed was insisting that they’d hold rates near zero, before they completely shifted course. It was a hairpin turn, as you can see from the dot plots that record their past forecasts.

Sixth, and most fundamentally, this isn’t really about “duration risk”, it’s about the Fed’s devaluation policy. This wasn’t some random risk like a bolt of lightning, these bonds lost value because the Fed made them lose value. And if it was just one bank that had an issue with these bond purchases, yes, it’d be a bank problem…but hundreds of banks have this issue, so it’s a central bank problem. As Stanford, FDIC, and the Fed itself have admitted.

All of this is why the Fed had to roll out its BTFP program, to buy back the bonds it had devalued. It bought them at 100 cents on the dollar, but from favored parties only, because it knew it had created a problem that the system couldn’t “hedge” against.

This is the argument that some random H1B in Sunnyvale was responsible for diligencing their employer’s bank’s financial statements to find the hidden footnote on page 73 disclosing the stealth insolvency…but Jerome Powell wasn’t responsible for bankrupting the bank in the first place by hiking rates, despite being fully aware that this would happen.

The related argument is that all the companies that stored money in US banks should have been aware of the arbitrary FDIC limit…despite (a) the FDIC systemic resolution committee itself admitting that they intentionally kept depositors in the dark about the process and (b) the contention that anyone who raises awareness of the potential insolvency of the US banking system is contributing to bank runs. So, somehow all the companies should have taken measure to ensure against the systemic unsoundness of the US banking system, while the FDIC was hiding this unsoundness from the public, and people were (and still are!) attacked for publicly speaking about the US banking system’s unsoundness.

iPhone analogy is great

the most footnoted blog posts in history. thank you again for the education. Its probably the number one reason i watch zero news. I wait for the outcomes to trickle down to me. The only ones that actually matter are the ones that withstand the average news cycle. Also love seeing again a side by side of major news media reporting and looking at it like “he chatgpt give me 10 possible versions of a headline blurb about 390,000 job increase” and viola, instant mass media reports that all say the same exact thing with different adjectives. Sounds a lot like some pre-fourth turning action. 🫶🏼