Bond Villain

When Powell devalued bonds, he destroyed the economy.

I’m not really interested in the endless primary battle between Trump and DeSantis for the Republican nomination. But I am interested in this recent salvo by Trump-supporter Laura Loomer — mainly because I anticipate many more things like it, where group A blames group B for economic losses caused by the Fed.

Check it out:

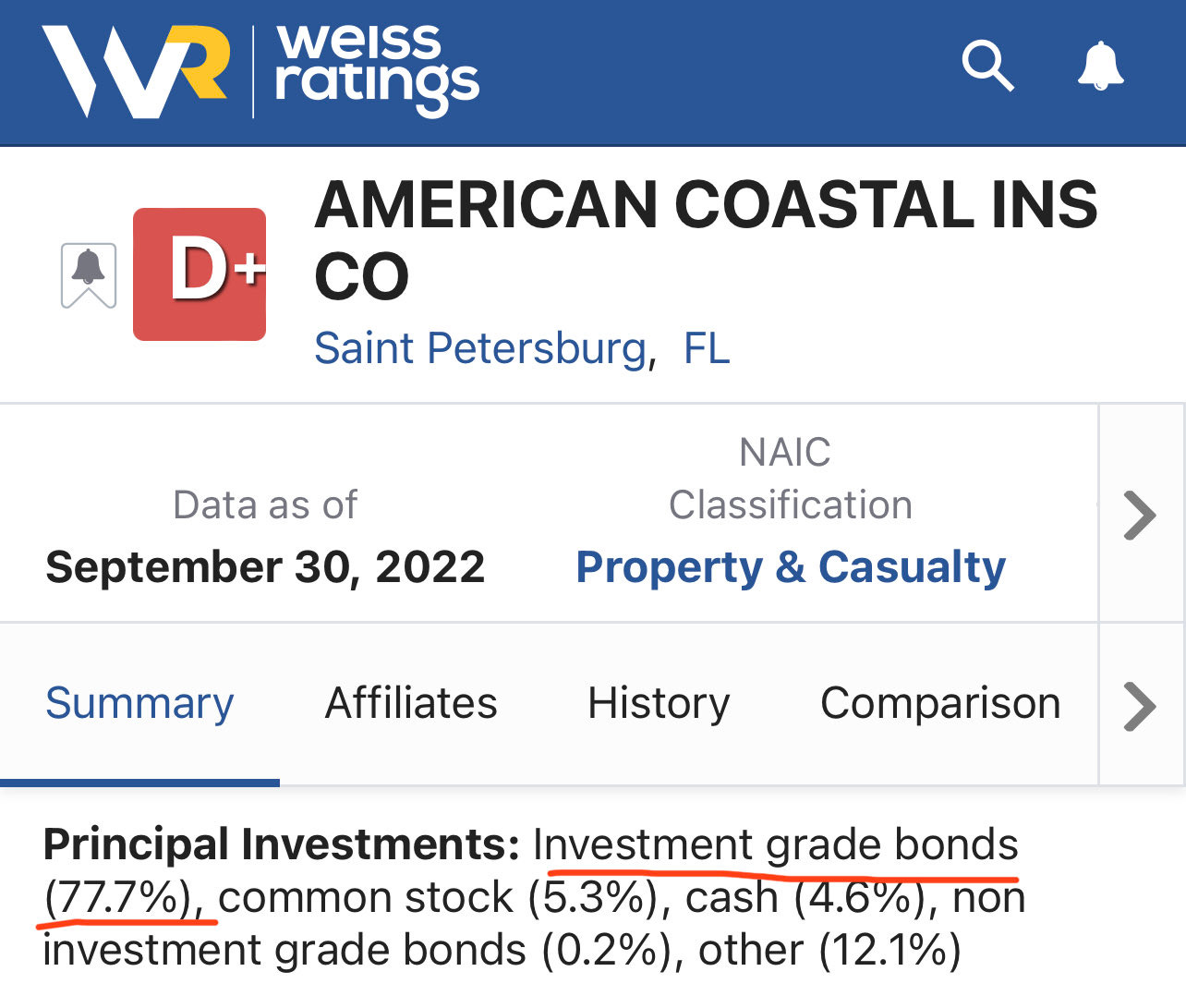

Loomer is accusing Florida’s state government, and by extension DeSantis, of somehow being derelict in the management of these insurance companies. And the thing is, it’s quite likely that many insurance companies are indeed underwater.

But if so, that’s the fault of the Fed, not Florida.

Why? Well, one of the insurance companies named below is American Coastal. And Weiss Ratings reports they put 77% of their portfolio into safe, investment-grade bonds. Problem is, thanks to the Fed, bonds are no longer safe.

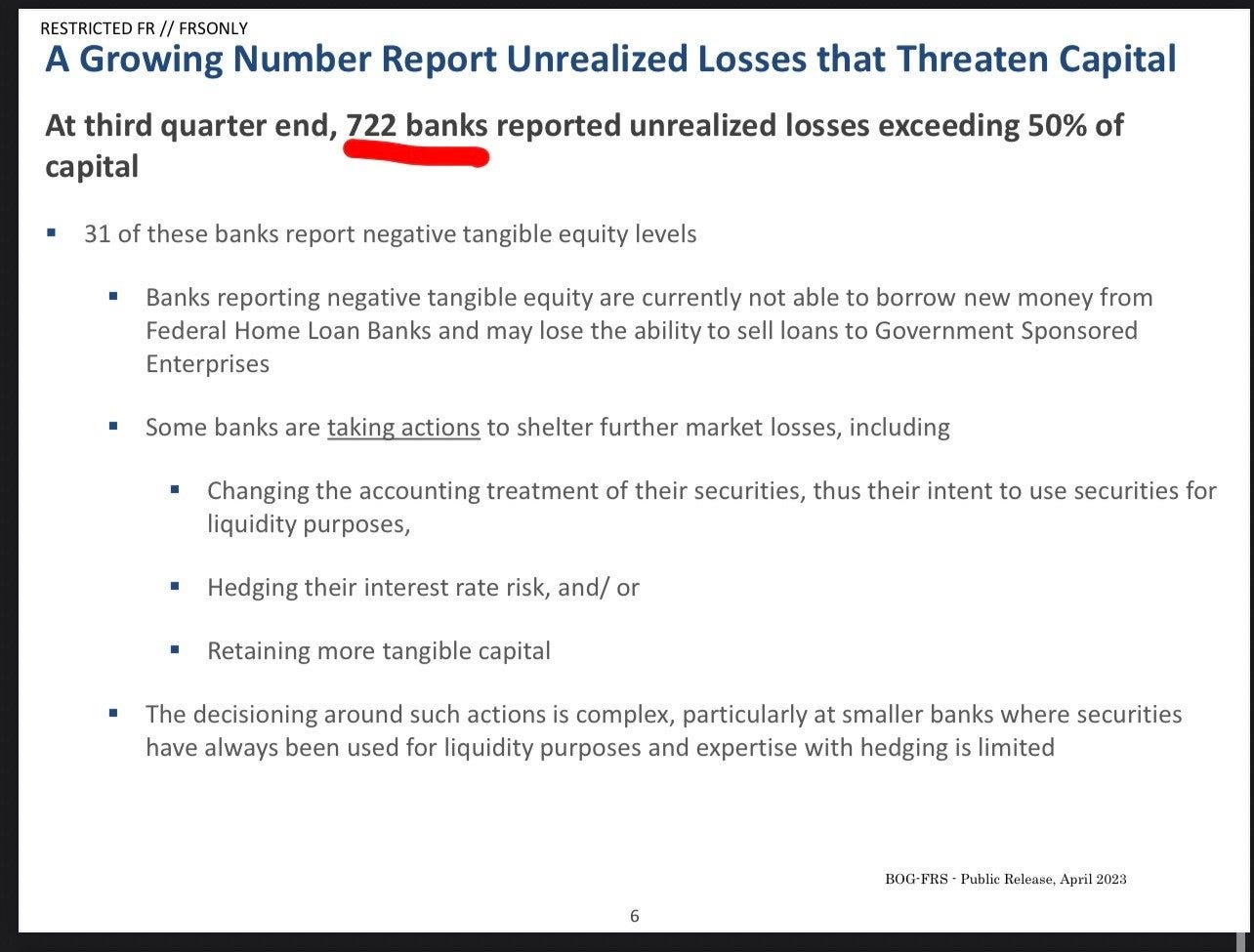

See, many financial institutions bought supposedly safe bonds from the government in 2021. But then that same government did a massive surprise devaluation of all of the bonds it had just sold — screwing over its biggest customers, from banks to insurance companies, causing the largest losses in bond history, and saddling institutions what Stanford researchers estimate to be literally trillions in unrealized losses.

These bond losses remain “unrealized” so long as people don’t come looking for their money. But when they do — like during a bank run when banks must pay out, or during hurricane season when insurance companies must fork over cash — then bad assets are sold and losses become “realized.”

And then we all “realize” that the poor dumb institutions that bought US government bonds in 2021 are actually insolvent — unless the Fed prints to paper over a bond crisis the Fed itself caused. Which it will do, over and over again, until the crisis devalues the dollar itself.

Anyway, this is what happened in March 2023 when five huge banks died in quick succession, followed by a quick print called BTFP to cover up the Fed’s failure. Bond losses are why Roubini is saying “most” banks are insolvent and why Bank of America alone has $100B in unrealized losses. A similar phenomenon in Europe1 is why Germany’s central bank apparently has negative equity and pensioners face massive losses.

And this is all just the tip of the iceberg.

Jerome Powell and Janet Yellen are bond villains. They destroyed every institution that trusted their words in 2021. They said inflation was transitory and that they’d keep rates low even as late as November 2021. They sold billions in bonds on that false pretense. Then the Fed executed a surprise rate hike, devaluing all the bonds the government had just sold, and turning Treasuries into the new toxic waste.

I discussed all this here and here, even mentioning insurance companies as bust months ago. The thing to understand is that this financial hurricane won’t be limited to Florida.

FAQ

Why didn’t bond buyers hedge?

I hear this question a lot. I’m a little surprised that I hear it, because if you know enough to mention hedging duration risk…then you should know that the situation of the last few years was impossible for the system as a whole to hedge.

But here’s a reasonable version of the question:

The short answer

The short answer is that if one bank has an issue it’s a bank problem, but when hundreds of banks have an issue it’s a central bank problem. And the Fed and FDIC and others have known for a while that literally hundreds of banks (and other bond-buyers, like insurance companies) have this problem — which should tell you that it wasn’t trivial to “manage duration risk” of this magnitude.

The long answer

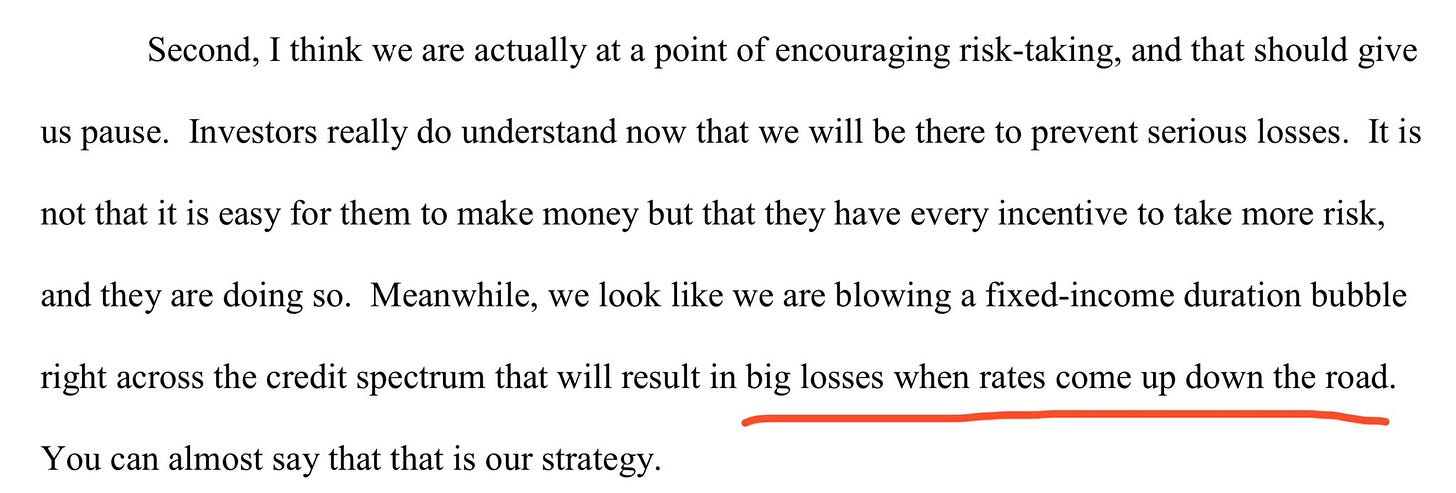

“Nobody hedged.” And why would they? Because hedging is expensive, and in 2021 the Fed kept saying inflation was transitory, as explained in the clip below.2

Thing is, hedging is like buying an insurance policy. And you might well buy car insurance. But do you go through life buying personal insurance policies for plane crashes? You don’t, because (a) you don’t consider that a probable event and (b) the cost isn’t worth the benefit and (c) you’d be dead anyway. And that’s how people in 2021 thought about the idea of hedging a massive surprise rate hike to 5%.

In more detail:

Hedging isn’t free. Many people seem to think hedging is magic, and somehow delivers a risk-free return. But hedging is actually expensive and gives up scarce margin.

Hedging isn’t possible for extreme outcomes. For example, you can hedge a move from 1% to say 1.1%, but not 1% to 5% — especially within a single year! Something so dramatic changes the fundamental nature of the asset class.

Hedging gets combinatorial. You can hedge bonds on many different parameters. Interest rates are just one parameter. Another might be the probability of sovereign default. A third could be inflation. A fourth might be exchange rate risk if you’re working from a foreign jurisdiction. And so on and so forth, and that’s just for bonds. It quickly gets combinatorial and you can’t hedge every possibility without giving up all your margin.

Hedging was said by the authorities to be unnecessary. Back in 2021, we’d all just had 10+ years of low/zero rates and a strong public commitment from the Fed to keep rates low indefinitely. This message was reiterated all the way through November 2021, until the sudden reversal.

Hedging was low status. Really, hedging wasn’t just held to be unnecessary. The Treasury and Fed said inflation was “not to worry” about, and many journalists called it a baseless conspiracy theory in 2021, so it was low status to hedge!

Hedging just shifts the risk to someone else. It doesn’t fix the systemic devaluation the Fed and Treasury caused. You’re just playing hot potato. Someone is stuck holding these horrible bonds.

Hedging is impossible if you’ve marked the devalued bond as hold-to-maturity. This is technical, but bankers that were surprised by the Fed’s rate hikes in 2022 tried surprising their depositors and investors by hiding their losses in their balance sheets with what I call “hide-to-maturity” accounting, essentially pretending that the loss didn’t happen. But once they did this, they couldn’t easily hedge the asset as it was no longer available for sale.

Hedging is impossible if the rulebook makes you buy bonds. The entire Western financial system is premised on long-term US government bonds, especially Treasuries, as having the “risk-free rate of return” and being the safest asset around. And many rulebooks encourage (or require) financial institutions to buy these so-called high quality liquid assets. So they were told to buy massive amounts of assets that the Fed then devalued.

Hedging deals with duration risk, not devaluation policy. Rates aren’t an organic market phenomenon, they’re set directly by the Fed. So even the term “duration risk” isn’t right — it’s really devaluation policy. Remember, rate hikes weren’t a lightning bolt from the blue that no one knew about, they were a surprise attack from the Fed. Look at Powell’s own comments from 2012 on page 193 of this pdf — he knew rate hikes would cause massive losses.

Put all that together. Most banks nowadays3 are run by risk-averse committees of NPCs. You think that in mid-2021 the banks were going to spend a big chunk of their margin hedging a massive rate hike, an event that hadn’t happened for 10 years, a risk that the Treasury and Fed said vociferously wouldn’t4 happen? No, all these lemmings were led off a cliff because they trusted Treasury and followed the Fed.

In short: all the mid-2023 commentary about hedging duration risk is 20/20 hindsight. It’s like asking five years from now “why didn’t you hedge debasement risk”, as if “everyone knew” that de-dollarization is happening and that you should hedge into gold, Bitcoin, or a non-US-controlled fiat currency.

Inflation wasn’t an establishment-approved thing to hedge in 2021, and de-dollarization isn’t an establishment-approved thing to hedge in 2023.

The visual answer

Powell often talks about a “soft landing”, which implies he’s the pilot of the economy. Hedging is like fastening your seatbelt against expected turbulence. And that’s a good practice much of the time. But if the pilot is crashing the plane, which is what Powell is doing, then no amount of seatbelt fastening will save you.

Feedback

On a totally different note…I tweet whenever I feel like it, but I’m trying to figure out the right cadence to send the newsletter. Some days I’ll have multiple posts, and other days maybe none. I also want to have digest-style posts every few days of all the podcasts and other things I’m doing.

Maybe the answer is to send at most one email per day, but tweet every post as I do them. What do you think? Also comment below and at balajis.com/chat.

Yes, it’s true that the German Fed’s problems are due to buying trillions of dollars of bonds from eurozone countries rather than the US specifically. But the Fed specifically and the US government more generally is extremely influential on European monetary policy. And people like Christine Lagarde argue for even greater “policy cohesion” among the Western bloc. So to first order, you can model it as “Powell and the Fed raised rates and devalued bonds, and a similar phenomenon happened in most other Western countries” and you won’t be that far off. Then as a second order thing you can look at policy divergences.

In the clip they’re discussing hedging rate hikes in the context of loans, but it’s similar for bonds. People didn’t have any expectation of massive rate hikes during the pandemic.

Much of the risk-tolerant DNA has gone to fintech, crypto, startups, or hedge funds.

Today, yes, “everyone knows” that inflation is happening, but it was only acknowledged by the establishment in December 2021…well after hundreds of billions of dollars worth of bonds had been sold under false pretenses.

I would love some more actual recommendations other than buying bitcoin and gold, which is difficult to do with a 401k. Dalio is reticent to recommend anything but he’s held to a different standard when giving investment advice too. Thanks for another amazing post.

Really enjoy your posts and thinking.