The Bitcoin ETF is the spiritual reversal of Executive Order 6102

Back in 1935, they seized the gold. But now, digital gold is back.

History is running in reverse.1

Ninety years ago, FDR and his fellow travelers rode the 20th century arc of centralization. The chokepoints of then-new technologies for mass media and mass production allowed them to gain control over the population, recruit top talent for their "Brain Trust", and seize the gold after a series of epic legal battles.

Those gold clause cases are forgotten today, but received as much contemporary coverage as 9/11 or the Moon Landing. They were the most important issue in the country, receiving far more coverage than seemingly comparable Supreme Court decisions like Roe vs Wade. Why?

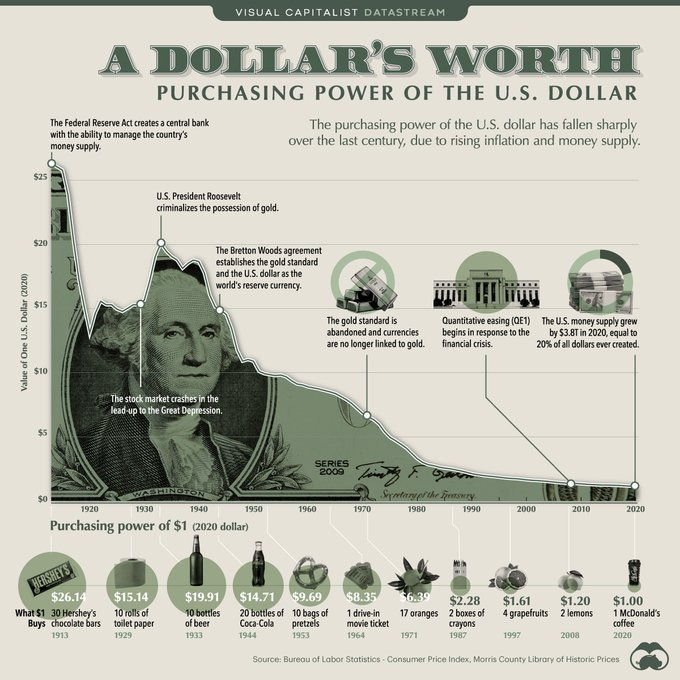

The reason is that the transition from a gold-backed to fiat-backed system was comparable to a soft communist revolution, as the *visible* seizure of gold laid the groundwork for the *invisible* seizure of wealth via money printing.

And the classically trained judges at that time fully understood this. Justice McReynolds' then-famous dissent denounced the ruling in the harshest terms, noting that the "Constitution is gone" and the "dollar...may be 30c tomorrow, 10c the next day, and 1c the day following".

McReynolds was right. While the court was forced into a grudging institutional surrender by FDR's threat of court-packing[2], the gold clause case affected every economic decision-maker in the country, as it amounted to the US government explicitly defaulting on its bonds by seizing the assets of its citizens, laying the groundwork for the century of monetary debasement to come.

Now all of that is unwinding. FDR's team could ride the wave of centralizing technology that built giant states around the world. But today, technology favors *decentralization* — personal computers, end-to-end encryption, mobile phones, and of course cryptocurrency.

Thus, top talent isn't being pulled into a government Brain Trust. It's being brain drained *out* of the US establishment. And as a consequence the epic legal battles are, on balance, going our way.

It's not just the DC Circuit case. The ideological conflict between decentralization and centralization is reflected in the 3-2 vote for the Bitcoin ETF approval itself. Read Peirce's brilliant pro-liberty approval, Crenshaw's dour denial, and Gensler's reluctant approval.

You'll see echos of the gold clause case, but in reverse. This time, it is the centralized state that is being forced into a grudging institutional surrender. And a surrender it is, as Crenshaw's dissent makes clear:

"...there is no primary regulator for the bitcoin spot markets. Spot bitcoin ETPs will be participating in an unregulated, fragmented, continuously traded, global free-for-all. Even if there were a primary regulator for this market, much of it could be beyond the reach of U.S. regulation..."

Let that sink in! This is what the US establishment truly fears: not Bitcoin as "fraud", but Bitcoin as freedom. They want to rule not just you but the world, so they're scared of the prospect of "a global free-for-all..beyond the reach of US regulation". And they know that any spot ETF will bid up the price of self-custodied Bitcoin outside their control, as Satoshi intended.

So: since FDR's seizure of gold, our lives have revolved around the centralized state rather than the decentralized market. The state has had control for so long we've forgotten what freedom is like. But now gold is slipping out of their hands, and back into yours.

And history is running in reverse.

This post originally appeared on Twitter. See also the Network State book chapter on how Our Future is Our Past.

Never underestimate Bitcoin's game theory. Satoshi definitely understood the Art of War. You definitely need to be when playing chess against these monopolistic tyrants!

Always look forward to your articles and this one didn't disappoint

I'm going to play devils advocate here, and suggest that ETF may not signify the end of the US dollar, but perhaps it's last attempt to bring BTC under its control.

As your article suggests, Gold has long been a thorn in the shoe of empire - a mirror reflecting the ongoing debasement of fiat currencies, something that had to be dealt with at all costs.

In the 2000's the first gold ETF was introduced, which indeed fueled a rise in the gold price, but also has been used since as a tool surpress gold value against the dollar.

How is this done? - here is gpt's response:

Critics argue that the gold price is suppressed through the creation of paper gold in the form of GLD ETFs.

Some claim that the issuance of GLD shares, not backed by equivalent physical gold, dilutes the market and artificially depresses gold prices.

Allegations suggest that large-scale trading in GLD options and futures can lead to downward pressure on gold prices.

Critics point to the lack of transparency in GLD's gold holdings, raising concerns about the true correlation between the ETF and the actual gold market.

The perception of synthetic gold creation through ETFs is contended by some as a factor contributing to the suppression of gold prices.

Now, I understand we are talking about a 'Spot' BTC ETF, meaning that 1 btc will have to be 'custodied' against 1 btc derivative. Audits are potentially easier due to BTC's public blockchain, but this will mean tracking the volume of 'paper' BTC issued against 'real' BTC. My question is, who will be monitoring this? and who watches the watchmen? - will it be left to the wolves of wall street and their friendly regulators?

By its Fiat nature, the dollar will defeat any derivative it's pitted against, and whilst we can chant the mantra of ' not your keys not your coins' , Most peope to refer to the The GLD derivative price when valuing gold rather than the price it would cost to actual take delivery of an ounce...

Satoshi recognised the dangers of fiat currencies, central banking, counterparty risk. I posit he would regard ( using star wars as a reference) the ETF is a case of the Empire striking back / revenge of the sith - rather than a new hope!

Again I'm simply playing devils advocate, and here to learn.

Very interested in hearing your counter-arguments :)